Loading

Get Nh Dp 8 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Nh Dp 8 Form online

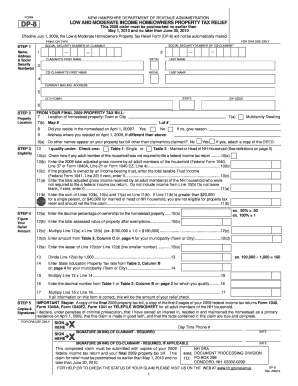

Filling out the Nh Dp 8 Form online is a straightforward process that provides homeowners with property tax relief based on their income levels. This guide will walk you through each section of the form, ensuring you have all the necessary information to complete it effectively.

Follow the steps to fill out the Nh Dp 8 Form online.

- Press the ‘Get Form’ button to acquire the Nh Dp 8 Form and open it in the online editor.

- Begin by entering your name and address details along with the social security numbers of both the claimant and co-claimant. Ensure you provide any necessary additional information about other adults in the household if applicable.

- In the property location section, use your final property tax bill to enter the location of your homestead property, including the town or city, and the map and lot number if applicable. Confirm whether you lived at the homestead on April 1, 2009, and provide the address you resided in if different.

- Complete the eligibility part by indicating whether you qualify as a single person or a married head of household. Enter the required income details from your 2009 federal income tax returns.

- Calculate your relief amount by entering the decimal percentage of your ownership of the property and the total assessed value after exemptions. Follow the provided lines to complete your calculations based on your municipality's property values.

- Assemble the necessary documentation, including copies of your 2009 property tax bill and federal income tax returns. Ensure all signatures are affixed in ink for both the claimant and co-claimant.

- Review all entries for accuracy, then save any changes made. You can download, print, or share the completed Nh Dp 8 Form as needed.

Start completing your Nh Dp 8 Form online today for property tax relief.

What does homestead mean in New Hampshire? New Hampshire has the homestead exemption. ing to CATIC, the homestead exemption in New Hampshire allows a property owner to protect up to $120,000 of equity in his or her home from attachments or forced sale by creditors for payments of debt.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.