Loading

Get W3 Employer Reconciliation Form - City Of Warren Ohio - Warren

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the W3 Employer Reconciliation Form - City Of Warren Ohio - Warren online

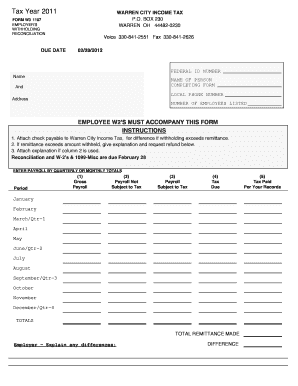

The W3 Employer Reconciliation Form is an essential document for employers in Warren, Ohio, to report their employee withholding income tax. This guide provides a clear, step-by-step approach to completing the form online, ensuring compliance and accurate reporting.

Follow the steps to successfully complete the W3 Employer Reconciliation Form online.

- Press the ‘Get Form’ button to access the W3 Employer Reconciliation Form and open it in your editor.

- Enter your federal identification number in the designated field. This is crucial for identifying your business.

- Fill out the name of the person completing the form. Ensure that the name is clear to facilitate communication.

- Provide the local phone number where you can be contacted regarding the form.

- Input your complete address in the designated area to reflect your business location.

- Indicate the number of employees listed for the reporting period; this number should correspond to your payroll records.

- Ensure that all employee W-2 forms are attached to this reconciliation form, as they are necessary for processing.

- Review the instructions: Attach a check for any difference if withholding exceeds remittance, or provide an explanation and request a refund if the remittance is higher.

- Fill out the payroll totals for each month or quarter in the sections provided: Gross Payroll, Payroll Not Subject to Tax, Payroll Subject to Tax, and Tax Due.

- Calculate and enter the total remittance made at the end of the payroll totals section.

- If applicable, explain any discrepancies in the section labeled 'Employer - Explain any differences'.

- Finally, review your entries, make necessary changes, and then save the completed form, download, print, or share it as needed.

Start filling out the W3 Employer Reconciliation Form online to ensure your tax compliance.

The rates range from 0.25 percent to 2.5 percent of taxable earnings.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.