Loading

Get Form 27q Statement Tax Income Sub Section Online

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 27q Statement Tax Income Sub Section Online

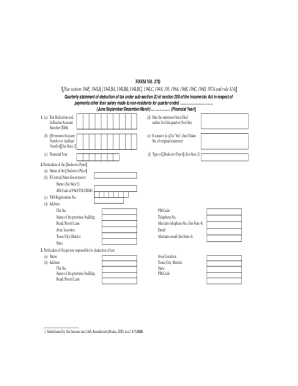

The Form 27q Statement Tax Income Sub Section is essential for documenting tax deduction at source (TDS) for payments made to non-residents. This guide will provide clear, step-by-step instructions on how to complete the form online, ensuring accuracy and compliance with tax regulations.

Follow the steps to fill out the Form 27q online effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in the Tax Deduction and Collection Account Number (TAN) in the designated field. Ensure this number is accurate as it identifies your tax account.

- Indicate whether this statement has been filed earlier for the current quarter by selecting 'Yes' or 'No'. If it has been filed, provide the Token Number of the original statement.

- Enter the Financial Year applicable to this statement.

- Provide your Permanent Account Number (PAN) or Aadhaar Number, if required. Non-government deductors must include this information.

- Complete the details for the deductor/payer section, including name, TAN registration number, and complete address.

- In the person responsible for the deduction section, include their name, address, telephone, and email information.

- Fill out the details of tax deducted and paid to the Central Government, ensuring to include the correct amounts for tax, surcharge, education cess, interest, and any penalties.

- Provide the mode of deposit, along with the BSR code/receipt number and date of payment.

- Include the details of the deductees such as their names, PAN or Aadhaar numbers, and the amounts paid to them, ensuring accuracy for tax deducted from these payments.

- Complete the verification section by certifying that all provided information is correct. This should include the signature and details of the person responsible for deducting tax.

- Once all fields are completed, save your changes. You will then have the option to download, print, or share the form as needed.

Begin filling out your Form 27q online today to ensure compliance and accuracy in your tax reporting.

Filing TDS returns with Form 27Q The TDS return can be prepared only by using the NSDL e-Gov e-TDS/TCS Return Preparation Utility (RPU) which is available for free download from the website of TIN. The return, once prepared, needs to be submitted to any of the TIN FCs which have been established by NSDL e-Gov.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.