Loading

Get Ph Bir 2000 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PH BIR 2000 online

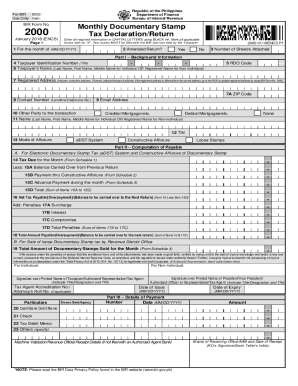

Filling out the PH BIR Form 2000 online is an essential process for taxpayers in the Philippines to comply with Documentary Stamp Tax obligations. This guide offers simple and clear instructions to help users navigate the form efficiently.

Follow the steps to successfully complete the PH BIR 2000 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Provide the month for which you are filing the return by entering the date in the MM/DD/YYYY format in the designated field.

- Indicate if this is an amended return by marking the appropriate box with an ‘X’ for ‘Yes’ or ‘No’.

- Enter the ‘Number of Sheet/s Attached’ to specify any additional documentation submitted with the form.

- In Part I, fill out the background information, including Taxpayer Identification Number (TIN), Taxpayer's Name, Registered Address, RDO Code, ZIP Code, Contact Number, and Email Address.

- Indicate the ‘Other Party to the transaction’ by marking the applicable boxes.

- Provide the name and TIN of the other party involved in the transaction.

- Choose the ‘Mode of Affixture’ by selecting one of the options: eDST System, Constructive Affixture, or Loose Stamps.

- In Part II, compute the payable tax by filling in the required fields for tax due, balances carried over, and payments made during the month as outlined in the form.

- Calculate the total amount payable, which includes penalties if applicable, and enter that amount in the final section.

- In the signature section, provide the required signatures along with the printed names and other pertinent details, ensuring representation if applicable.

- Review your entries for accuracy before finalizing. After ensuring that all data is correctly filled, save your changes.

- Download, print, or share the completed form as needed for submission.

Complete your PH BIR 2000 document online effortlessly today.

Related links form

Documentary stamp tax (DST) in the Philippines is generally, a tax imposed on the exercise of certain rights to enter into specific transactions, acts, and deeds relative to business or dealings or properties as manifested by related documents and papers.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.