Loading

Get 3520 Be Instructions

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 3520 BE instructions online

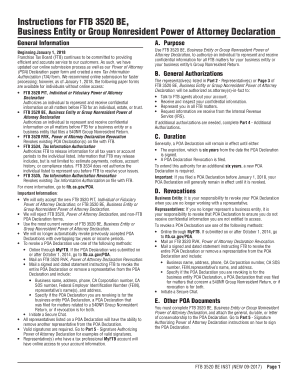

Filling out the 3520 BE, Business Entity or Group Nonresident Power of Attorney Declaration, online can simplify the process of authorizing an individual to represent your business entity before the Franchise Tax Board (FTB). This guide provides clear, step-by-step instructions to ensure accurate and efficient completion of the form.

Follow the steps to successfully complete and submit the 3520 BE instructions online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill out Part 1 - Business Entity Information. Select the appropriate checkbox for either the Business Entity or 540NR Group Nonresident Return, and provide the required details, including the legal business name, CA corporation number, or Federal Employer Identification Number (FEIN) as applicable.

- Move to Part 2 - Representative(s). List at least one primary representative. You may add additional representatives using Page 3 of the form, if necessary.

- In Part 3 - Authorization for All Years or Specific Income Periods, indicate whether you authorize your representative(s) to represent you for all years or for specific income periods. Be sure to mark Not Applicable (NA) in any blanks as required.

- Complete Part 4 - Additional Authorizations to grant your representative(s) additional powers if desired, such as the ability to waive the California statute of limitations or execute settlement agreements.

- In Part 5 - Signature Authorizing a Power of Attorney Declaration, ensure that the signature is valid. It must include the signer's title and be dated appropriately.

- After reviewing the completed form for accuracy, save your changes. You may then download, print, or share your filled-out form as needed.

Complete your 3520 BE online today for faster processing.

The penalty for filing a delinquent Form 3520 is 5% of the value of the unreported gift for each month that passes after its due date. The maximum penalty is 25% of the amount of the gift. Form 3520 is due at the time of a timely filing of the U.S. income tax return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.