Loading

Get Lender Application Form - Paycheck Protection Program Loan ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

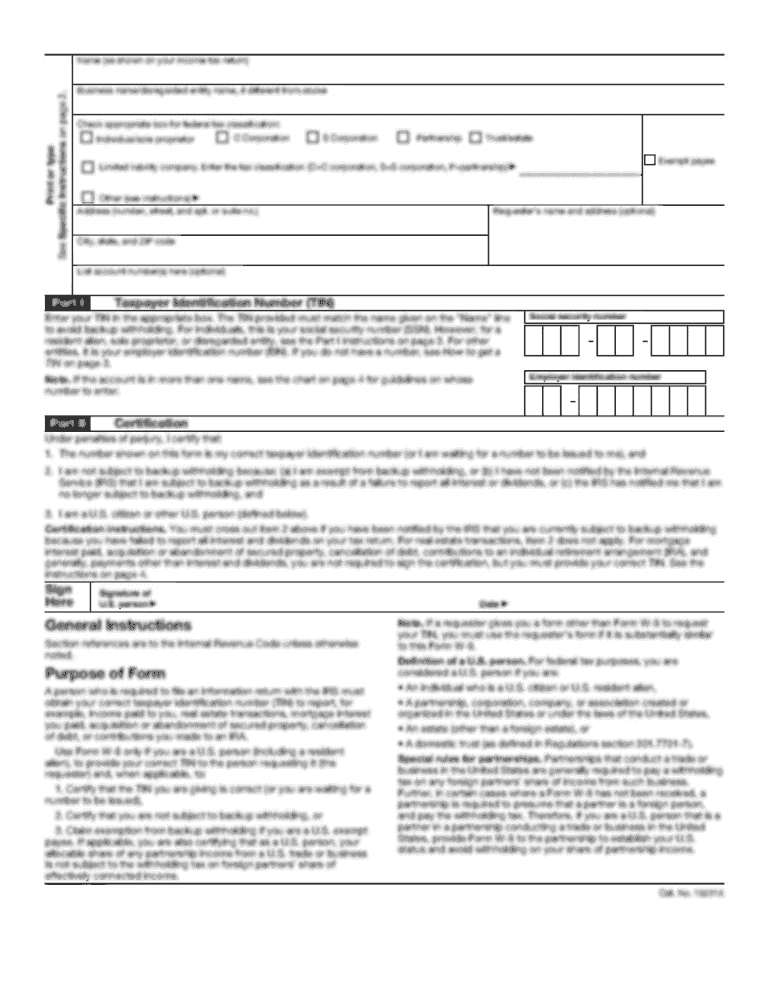

How to fill out the Lender Application Form - Paycheck Protection Program Loan online

This guide provides a comprehensive overview of the process to fill out the Lender Application Form for the Paycheck Protection Program (PPP) loan online. With clear instructions and tips, this resource aims to simplify the application process for users at all experience levels.

Follow the steps to complete your application effectively.

- Click 'Get Form' button to obtain the Lender Application Form and open it in your browser.

- Contact information: Fill out the primary owner’s contact details, which include their first name, last name, email, phone number, address, and Social Security number.

- Business information: Enter your business name, business EIN, business phone number, the type of business, state of incorporation, business address, date established, website, and a brief description of what your business does.

- Loan data: Specify the purpose of the loan, the amount you are requesting, and provide details regarding current employees and jobs created or retained.

- Owner background: Provide background information about the primary owner, including any prior convictions, tax liens, defaulted government loans, existing SBA debt, and exhaustion of personal financing options.

- Document upload: After completing all sections, click 'Upload Files' to submit the required documents, ensuring all fields are filled correctly before proceeding.

- Submission confirmation: Once submitted, a confirmation message will appear. You will also receive an email with further instructions within 72 hours.

- Portal activation: Use the email confirmation to activate your Lendistry portal account with the provided login credentials.

- Password update: Update your password upon first login to secure your account.

- Payroll calculator: Access and fill out the appropriate payroll calculator for your business type to ensure accurate loan calculations.

- Review application: Go over the auto-populated responses in the portal to verify that all information is accurate before final submission.

- Link bank account: Finalize your application by linking your bank account for direct deposit of funds, ensuring all required steps are completed for your application to be processed.

Start filling out your application for the Paycheck Protection Program loan online today.

Step 1: Access your PPP Application. ... Step 2: Add or Confirm Existing Business Information. ... Step 3: Add New Requirements for Business Information. ... Step 4: Enter or Confirm Ownership. ... Step 5: Enter or Confirm Additional Owner Info. ... Step 6: Upload or Confirm Documents.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.