Loading

Get Irs Form 709 For 1990 1994

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Form 709 for 1990-1994 online

Filling out the IRS Form 709, also known as the United States Gift (and Generation-Skipping Transfer) Tax Return, can seem daunting. This guide is designed to provide a clear and straightforward approach to help you complete the form online, ensuring you understand each section and field thoroughly.

Follow the steps to fill out the IRS Form 709 online effectively.

- Click ‘Get Form’ button to access the IRS Form 709 and open it in the editor.

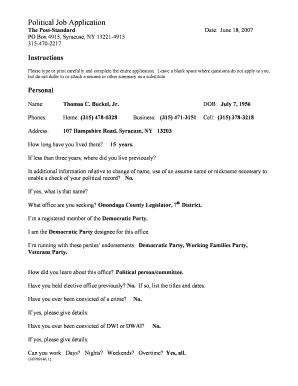

- Provide your name and contact information in the personal details section. Make sure to include your mailing address, phone number, and any relevant additional information. If you are submitting the form for the first time, check the box as applicable.

- Fill in your date of birth and relevant financial details. This section may ask about your marital status, which can be important for certain tax considerations.

- In the gifts section, detail each gift given during the year. Include information like the recipient's name, description of the gift, date gifted, and the fair market value at the time of the gift.

- If you are claiming any deductions or exclusions, ensure to properly detail these in the provided sections. This may include gifts made to spouses or charitable organizations.

- Review the section for reporting generation-skipping transfers, if applicable. Complete any necessary fields that pertain specifically to such transfers.

- Double-check all entries for accuracy. Make sure you have correctly filled out all required fields and calculations are accurate.

- Once everything is complete, you can save your changes, download the completed form, or print it directly from the editor to submit to the IRS.

Complete your IRS Form 709 online today and ensure your gift tax filing is accurate and timely.

In tax year 2022, gifts exceeding the annual exclusion of $16,000 will trigger the gift tax. Tax would be owed on any amount over $16,000. The giver of the gift is required to file Form 709. For 2023, the annual exclusion is $17,000.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.