Loading

Get Uk Ct600 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK CT600 online

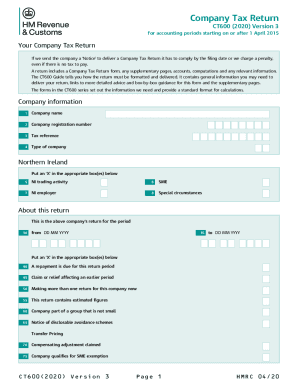

Filling out the UK CT600, the company tax return form, is a critical process for organizations operating within the UK. This guide provides you with comprehensive, step-by-step instructions on how to accurately complete the form online, ensuring compliance and accuracy in your tax submissions.

Follow the steps to accurately complete your UK CT600 form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling in the company information section. Enter the company name, registration number, and tax reference. Indicate the type of company by marking the appropriate box.

- Next, specify the accounting period for the company return by entering the start and end dates. Indicate any circumstances that apply to this return by marking the relevant boxes.

- Attach any necessary accounts and computations that relate to the return period. If applicable, indicate if they are for a different period or explain why they are not attached.

- Complete the tax calculation section by providing turnover details and breakdowns of various income types. Ensure to accurately reflect trading profits, losses, and any required deductions.

- Carefully go through the deductions and reliefs section and enter details related to losses, management expenses, and other qualifying deductions.

- Proceed to the profits chargeable section, calculating and entering the corporation tax based on the profits and applicable tax rates.

- Complete the indicators and information sections, detailing any claims for R&D credits or relevant expenditures. Ensure to mark the appropriate boxes.

- Fill out the overpayments and repayments section if applicable, providing necessary details for any repayments due.

- Finally, fill in the bank details for any repayments, complete the declaration section, and ensure to provide your name, date, and status before submission.

- Once all information is accurately filled out, save changes, download a copy, print, or share the form as needed.

Take action now and complete your UK CT600 online to ensure timely and accurate tax compliance.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Reference number Use your 17-character Corporation Tax payslip reference for the accounting period you're paying. You'll find the payslip reference: on any payslip that HMRC sent you. through your company's HMRC online account - choose 'View account' then 'Accounting period'

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.