Loading

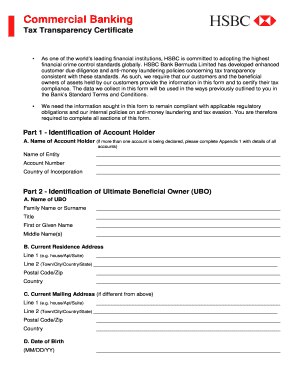

Get Tax Transparency Certificate Hsbc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tax Transparency Certificate Hsbc online

Completing the Tax Transparency Certificate Hsbc is an essential step for users to ensure compliance with tax regulations. This guide will provide a clear, step-by-step approach to filling out the form online, ensuring that all necessary information is accurately provided.

Follow the steps to successfully complete the form:

- Press the ‘Get Form’ button to obtain the Tax Transparency Certificate and open it in the online editor.

- In Part 1, enter the identification details of the account holder. Fill in the name of the entity, account number, and country of incorporation as required.

- Proceed to Part 2 to identify the ultimate beneficial owner (UBO). Start with their family name, followed by their title, first name, and middle name(s).

- Provide the current residence address of the UBO. This includes entering the complete address in the designated lines, along with postal code and country.

- If the current mailing address is different from the residence address, fill in Part 2C with the relevant details.

- In Part 2D, enter the UBO's date of birth using the format MM/DD/YY, and in Part 2E, provide the place of birth details, including both town/city and country.

- Specify the taxpayer identification number (TIN) in the allotted field in Part 2F.

- In Part 3, confirm the fulfillment of tax obligations. If applicable, indicate whether you have a tax advisor, and provide their details if you answer 'Yes'.

- Complete Part 4 by declaring the accuracy of the information provided. Sign the form, print your name, and include the date.

- If you have additional accounts to declare, fill in Appendix 1 with details of those accounts as necessary.

- Review all provided information for accuracy before choosing to save changes, download, print, or share the completed form.

Start filling out your Tax Transparency Certificate online today to ensure your compliance.

Current and historical gross margin, operating margin and net profit margin for HSBC (HSBC) over the last 10 years. Profit margin can be defined as the percentage of revenue that a company retains as income after the deduction of expenses. HSBC net profit margin as of June 30, 2023 is 26.43%.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.