Loading

Get Dfas Form 9415

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DFAS Form 9415 online

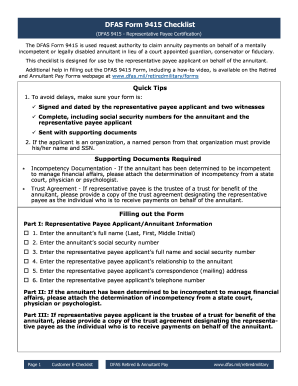

Filling out the DFAS Form 9415 online can seem challenging, but this guide provides clear instructions to help you through the process. This form is essential for requesting authority to claim annuity payments on behalf of a person who is unable to manage their financial affairs.

Follow the steps to complete the DFAS Form 9415 online.

- Click the ‘Get Form’ button to obtain the form and open it in the online editor.

- In Part I, provide the annuitant’s full name, including last name, first name, and middle initial. Ensure this information is accurate.

- Enter the annuitant’s social security number to verify their identity.

- Fill in the full name and social security number of the representative payee applicant. This is the person applying on behalf of the annuitant.

- Indicate the relationship of the representative payee applicant to the annuitant, which is crucial for establishing the proxy authority.

- Provide the mailing address of the representative payee applicant to ensure all correspondence reaches them timely.

- Include the telephone number of the representative payee applicant for any follow-up communication.

- If applicable, attach the determination of incompetency from a state court, physician, or psychologist in Part II.

- If the applicant is a trustee, attach the trust agreement in Part III, designating the representative payee as the recipient of the annuitant's payments.

- Complete Part IV by entering the representative payee applicant’s signature and date. Make sure this is done to validate the form.

- Both witnesses must sign and date the form as well, which is mandatory for the form's acceptance.

- Review your form for completeness, ensuring social security numbers, signatures, and supporting documents are included.

- Once you have completed the form, you can save your changes, download a copy, print it, or share it as needed.

Complete your DFAS Form 9415 online today to ensure timely processing of your annuity claims.

The Defense Finance and Accounting Service oversees payments to Department of Defense servicemembers, employees, vendors and contractors. The Defense Finance and Accounting Services also provides Department of Defense decision makers with business intelligence, finance and accounting information.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.