Loading

Get 2019 Montana Pass-through Entity Tax Return (form Pte ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2019 Montana Pass-Through Entity Tax Return (Form PTE) online

Filing the 2019 Montana Pass-Through Entity Tax Return (Form PTE) can seem daunting, but with the right guidance, you can complete it confidently online. This guide will provide you with clear, step-by-step instructions to ensure your form is filled out accurately and efficiently.

Follow the steps to complete your tax return online.

- Click 'Get Form' button to access the form and open it in the editor.

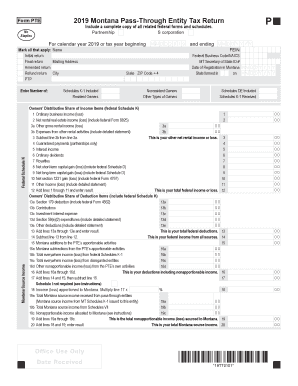

- Fill in the basic information at the top of the form, including the type of entity (Partnership or S corporation), the year of the tax return, and the applicable checkboxes for initial, final, amended, or refund returns. Make sure to accurately enter your entity's name, mailing address, and Federal Employer Identification Number (FEIN).

- Complete the section for Montana Source Income. Enter the total number of Schedules K-1 included and provide details regarding resident and nonresident owners.

- Proceed to report the Owners’ Distributive Share of Income Items. Carefully enter amounts for ordinary business income, net rental income, interest income, and any other specified income items, ensuring that all calculations are accurate.

- Fill in the Owners’ Distributive Share of Deduction Items, including Section 179 deductions and other applicable deductions. Make sure to include any required detailed statements.

- Calculate your federal income from all sources, total deductions, and proceed to calculate Montana additions and subtractions, and line 17 which is your income (loss) apportioned to Montana.

- Continue through the form, completing sections related to tax computations, including any tax credits, amounts owed, and refunds.

- Review all entries thoroughly for accuracy. Ensure any related federal forms and schedules are attached as required.

- Once completed, you can save changes, download copies for your records, print the form for mailing, or share the form as necessary.

Start filing your 2019 Montana Pass-Through Entity Tax Return online to ensure timely and accurate submission.

ing to Montana Instructions for Form 2, “you must file a Montana Individual Income tax return if your federal gross income meets the threshold and you lived or earned income in Montana during the tax year."

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.