Get Remove Late Payments

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Remove Late Payments online

Filling out the Remove Late Payments form can be a straightforward process. This guide provides detailed instructions to help you through each section and field, ensuring a smooth experience as you seek to address your late payment issue.

Follow the steps to complete the Remove Late Payments form effectively.

- Press the ‘Get Form’ button to access the Remove Late Payments form. This action will allow you to open the document in an online format for ease of completion.

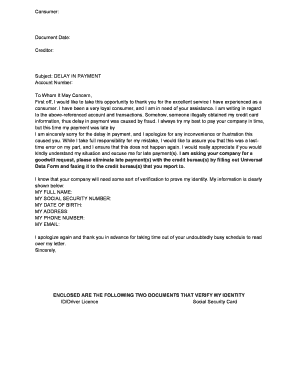

- Begin by filling in your personal information at the designated fields. This typically includes your full name, social security number, date of birth, address, phone number, and email address. Ensure that the information you provide is accurate to avoid any delays.

- In the section concerning your payment delay, clearly state the reasons for the late payment. Mention any instances of fraud that led to the unauthorized use of your payment information, as this context helps in processing your request.

- Express your gratitude and concern for the situation in a professional tone. Apologize for the inconvenience caused and convey your commitment to timely payments moving forward.

- Request the creditor's assistance by asking them to remove the late payment from the credit bureau documentation. Be polite yet assertive in your request, and mention that you appreciate their goodwill.

- Attach any verification documents required for identity confirmation. Typically, you may need to include a copy of your ID or driver's license alongside your social security card.

- Once all sections have been completed and verified, save your changes. You have the option to download, print, or share the form as necessary. Make sure all documentation is correctly included before submission.

Start completing the Remove Late Payments form online today to address your late payment issues.

Related links form

There's no evidence to suggest a 609 letter is more or less effective than the usual process of disputing an error on your credit report—it's just another method of gathering information and seeking verification of the accuracy of the report. If disputes are successful, the credit bureaus may remove the negative item.

Fill Remove Late Payments

After 30 days, you can only remove falsely reported late payments. It's a good idea to regularly check your credit scores and reports. If you want to get the late payments removed, consider writing goodwill letters. You can find the mailing address to the companies on your credit report. A goodwill letter is a formal written request asking a creditor to remove a negative mark, like a late payment, from your credit report. Generally, late payments drop off your credit history after 7 years, but it is important to get your credit card back in good standing as soon as possible.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.