Loading

Get State Form 4162 (r19 / 7-18)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the State Form 4162 (R19 / 7-18) online

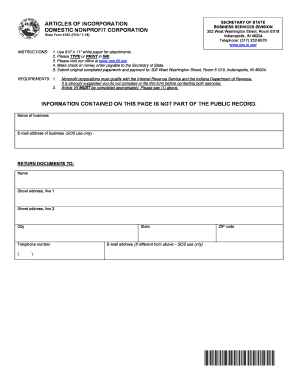

Filling out the State Form 4162 (R19 / 7-18) is an essential process for establishing a domestic nonprofit corporation in Indiana. This guide provides step-by-step instructions to assist you in completing the form accurately and efficiently online.

Follow the steps to fill out the State Form 4162 online:

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the name of the business in the designated field. Ensure that the name includes terms such as Corporation, Incorporated, Limited, or Company, or their abbreviations.

- Specify the principal office address, including the street number, street name, city, state, and ZIP code.

- Complete Article II by stating the specific purposes for which the corporation is formed. It is important to ensure this aligns with IRS requirements for 501(c) status.

- In Article III, choose the type of corporation by selecting one of the options: public benefit corporation, religious corporation, or mutual benefit corporation.

- Provide registered agent information in Article IV. Choose to list either a commercial registered agent or a noncommercial registered agent by filling out the respective information fields.

- Indicate whether the corporation will have members in Article V by selecting 'Yes' or 'No'.

- List the incorporator(s) in Article VI, including their names and addresses. Note that these details cannot be amended afterward.

- In Article VII, detail the distribution of assets upon dissolution or final liquidation, ensuring compliance with relevant IRS guidelines.

- Sign and date the document in the provided section, including the title and printed name of the signer.

- Once all fields are completed, save your changes, and proceed to download, print, or share the form as needed.

Complete your documents online today for a smoother filing process.

However, some nonprofits aren't required to pay sales tax on certain transactions. A sale is eligible for a sales tax exemption if: The organization is a qualified nonprofit. The qualified nonprofit registered with the Indiana Department of Revenue as a nonprofit organization no later than 120 days after its formation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.