Loading

Get Simple Ira Contribution Transmittal Form 2015-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Simple IRA Contribution Transmittal Form online

The Simple IRA Contribution Transmittal Form is essential for remitting contributions for your plan to Schwab. This guide will provide you with clear, step-by-step instructions to complete the form online, ensuring that you submit all required information accurately and efficiently.

Follow the steps to fill out the Simple IRA Contribution Transmittal Form online

- Press the ‘Get Form’ button to access the Simple IRA Contribution Transmittal Form, allowing you to open it in your preferred online editor.

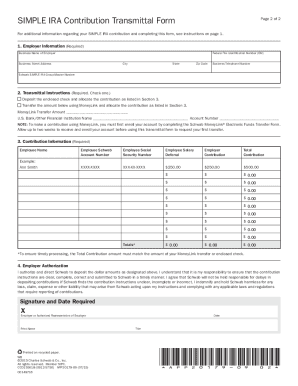

- Begin with the Employer Information section. Here, you will need to enter the Business Name of Employer, Federal Tax Identification Number (EIN), Business Street Address, City, State, Zip Code, and Business Telephone Number. Ensure all entries are accurate and match your official business records.

- In the Transmittal Instructions section, check one of the options provided. If you are enclosing a check, select the first option and indicate the total contribution in Section 3. If you prefer a MoneyLink transfer, select the second option and fill out the transfer amount, including the name of your U.S. Bank or other financial institution and account number.

- Proceed to the Contribution Information section. For each employee contributing, enter their name, Schwab account number, Social Security number, Employee Salary Deferral amount, Employer Contribution, and calculate the Total Contribution. Ensure that the totals align with the amount stated in your check or the MoneyLink transfer.

- In the Employer Authorization section, sign and date the form. It is crucial to ensure clarity and completeness in your instructions. Review all entries for accuracy before submission.

- Finalize your submission by saving any changes made. You can download, print, or share the form as necessary before mailing it to your nearest Schwab Operations Center.

Complete and submit your Simple IRA Contribution Transmittal Form online today.

The primary IRS form for establishing a SIMPLE IRA is Form 5305-SIMPLE. This form is critical for outlining the terms of the plan. Be sure to also have the Simple IRA Contribution Transmittal Form on hand for tracking contributions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.