Loading

Get Mo Modes-4 2019-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO MODES-4 online

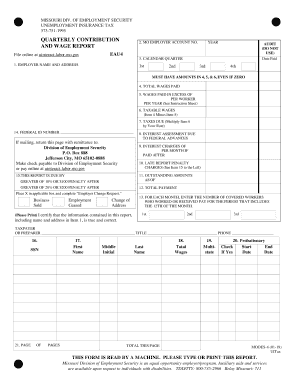

Filling out the MO MODES-4 form is an important step for employers reporting unemployment insurance taxes in Missouri. This guide provides a step-by-step approach to ensure you complete the form accurately and efficiently.

Follow the steps to successfully complete the MO MODES-4 online.

- Press the ‘Get Form’ button to access the MO MODES-4 document and open it in your preferred online editing tool.

- Begin by entering your employer name and address in item 1. Ensure that this information is accurate and matches your official records.

- In item 2, input your Missouri employer account number which is essential for identification purposes.

- For item 3, specify the calendar quarter you are reporting for—this could be the first, second, third, or fourth quarter of the year.

- Complete item 4 by entering the total wages paid during the reporting quarter. It is important to report all wages accurately.

- In item 5, provide the wages paid in excess of the limit per worker per year. Refer to the instruction sheet for specific thresholds.

- Calculate your taxable wages for item 6 by subtracting the amount in item 5 from the total wages in item 4. This figure is crucial for determining your tax liability.

- For item 7, multiply the taxable wages (item 6) by your applicable tax rate to determine taxes due.

- Proceed to complete items 8 through 12, which include any interest assessments, late penalties, and outstanding amounts if applicable.

- In item 13, enter the number of covered workers for each month of the quarter. Make sure to provide accurate counts.

- In the designated field, certify the accuracy of your report by detailing the taxpayer or preparer's full name, title, and phone number.

- Review all sections of the form for completeness and accuracy. Make necessary corrections before final submission.

- Once everything is complete, save your changes and prepare to submit the form online or print it for mailing. Ensure you keep a copy for your records.

Complete the MO MODES-4 form online today to streamline your reporting process.

To fill out the MO W-4 form, begin by providing your personal details, including your name and Social Security number. Follow the instructions to calculate your withholding based on the number of dependents you have and any adjustments you wish to make. It's vital to ensure your information is precise to meet the requirements of MO MODES-4. For clear instructions and tools, USLegalForms can guide you in completing the form confidently.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.