Loading

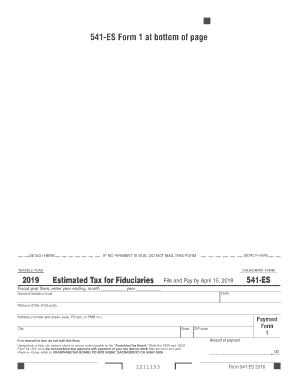

Get 2019 Form 541-es -estimated Tax For Fiduciaries. 2019 Form 541-es -estimated Tax For Fiduciaries

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2019 Form 541-ES -Estimated Tax For Fiduciaries online

Filling out the 2019 Form 541-ES -Estimated Tax For Fiduciaries is essential for proper tax management for estates and trusts. This guide provides a step-by-step approach to completing the form accurately and efficiently online.

Follow the steps to successfully complete the form:

- Click ‘Get Form’ button to access the form and open it in your editor.

- Fill in the taxable year. For this form, enter '2019' in the designated field.

- Indicate the type of entity by entering the name of the estate or trust in the corresponding field.

- Enter the Federal Employer Identification Number (FEIN) in the given format: 'XX-XXXXXXX'.

- Provide the name and title of the fiduciary responsible for the estate or trust.

- Complete the address section with the appropriate details, including street number, suite, or PO box.

- Fill in the city, state, and ZIP code of the fiduciary's address.

- If any payment is due, write the amount in the designated payment field.

- Using black or blue ink, prepare a check or money order for the payment, making it payable to the 'Franchise Tax Board'.

- Ensure that the FEIN and '2019 Form 541-ES' are written on your payment.

- Mail this form along with your payment to the following address: 'Franchise Tax Board, PO Box 942867, Sacramento CA 94267-0008'.

- If no payment is due, do not mail this form.

- Once you have filled and verified the form, you can save changes, download, print, or share the completed document as needed.

Complete your documents online today to ensure accurate submission!

If you fail to pay at least 90 percent of the taxes you ultimately owe for the tax year—or at least 100 percent of the tax you paid last year (110 percent if you're considered a high-income taxpayer)—you will face a 3 percent underpayment penalty. Of course, you'll also have to pay the taxes that are still due.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.