Loading

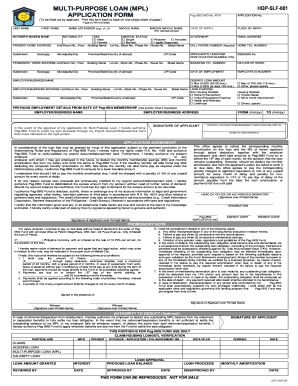

Get Multi-purpose Loan (mpl) Application Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MULTI-PURPOSE LOAN (MPL) APPLICATION FORM online

Filling out the Multi-Purpose Loan (MPL) Application Form online can seem daunting at first. This guide provides a clear, step-by-step approach to help users navigate through each section of the form with ease and confidence.

Follow the steps to complete the MPL application form successfully.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Carefully enter your Pag-IBIG MID Number or RTN in the provided field. Ensure that this information is accurate to avoid any issues during processing.

- Fill in your application number, date of birth, and place of birth. These details help verify your identity. Make sure to use the correct format for dates.

- Provide your citizenship information, email address, and your cell phone number. The cell phone number is mandatory to facilitate communication regarding your application status.

- Include your home telephone number and Taxpayer Identification Number (TIN). If you have a Social Security System (SSS) or Government Service Insurance System (GSIS) number, be sure to enter that as well.

- Detail your employment information, including the nature of work, date of employment, and employee ID number, if applicable. This section helps assess your financial stability.

- Provide your name and other identifying information, including last name, first name, middle name, and, if applicable, maiden middle name.

- Complete your present and permanent home address details, ensuring accuracy in units, building names, street names, and barangay sections.

- Fill in your employer or business name along with the company address. This information is crucial for loan processing and verification.

- Indicate the desired loan amount by selecting from the options provided based on the duration you intend to take the loan. Clearly specify your loan purpose by checking the relevant boxes.

- Review all the filled information carefully to ensure accuracy. Make corrections if necessary before submitting.

- After completing all fields, you can save changes, download the filled form, print it out, or share it as needed.

Take the next step towards your financial goals by completing your Multi-Purpose Loan application form online today.

Related links form

Calculations for the Pag-IBIG Multi-Purpose Loan amount are made ing to the individual's membership term, multiplied by their monthly contribution. From there, a 60% loan factor is applied. The amount you can loan increases as your monthly contributions increase, and so does the loan factor.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.