Loading

Get Za Escom Tax Evaluation Questionnaire

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ZA Escom Tax Evaluation Questionnaire online

This guide provides clear, step-by-step instructions for completing the ZA Escom Tax Evaluation Questionnaire online. By following these guidelines, users can ensure that all necessary information is accurately provided, facilitating the assessment of tax status.

Follow the steps to fill out the ZA Escom Tax Evaluation Questionnaire online effectively.

- Click the ‘Get Form’ button to obtain the ZA Escom Tax Evaluation Questionnaire and open it in your chosen digital platform.

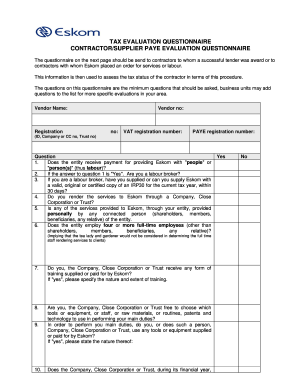

- Begin by entering the vendor name and any associated registration numbers, including the vendor number, VAT registration number, and PAYE registration number.

- Answer the first question regarding whether the entity receives payment for providing Eskom with individuals or labor. Choose 'Yes' or 'No' as appropriate.

- If 'Yes' is selected, proceed to indicate whether you are a labor broker in the second question.

- For labor brokers, confirm if you can supply Eskom with a valid, original, or certified copy of the IRP30 for the current tax year within 30 days.

- Specify if services are rendered to Eskom through a Company, Close Corporation, or Trust in question four.

- Indicate whether any services are provided personally by any connected persons of the entity.

- In the sixth question, confirm if the entity employs four or more full-time employees, not including connected persons.

- Respond to whether you receive any form of training supplied or paid for by Eskom; if yes, provide details about the training in question seven.

- Answer question eight regarding the freedom to choose tools or equipment used in providing services.

- For question nine, specify if tools or equipment are supplied or paid for by Eskom, and provide details if applicable.

- Indicate in question ten if your entity receives or anticipates receiving more than 80% of income relating to services from Eskom.

- Answer question eleven regarding whether Eskom controls your working hours.

- Specify in question twelve if the entity is controlled or supervised by Eskom and elaborate if necessary.

- Identify in question thirteen if your contract includes elements of an employment contract.

- Address whether the contract contains clauses enabling payments without work being completed in question fourteen.

- Answer question fifteen about any previous classification as a labor broker or personal services company.

- If applicable, elaborate on any changes that affect your classification in question sixteen.

- Complete the representative details section, ensuring to provide full names, signature, capacity, contact number, and date.

- Review your responses for accuracy, then proceed to save changes, download, print, or share the completed questionnaire.

Complete your ZA Escom Tax Evaluation Questionnaire online today to ensure proper tax status assessment.

Related links form

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.