Loading

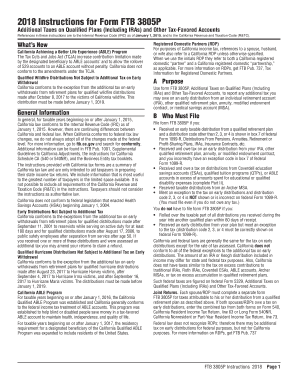

Get 3805p Instructions 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 3805p Instructions 2018 online

This guide provides step-by-step instructions on how to accurately fill out the 3805p Instructions 2018 form online. It is designed to assist users with varying levels of document experience in ensuring their tax-related documents are completed correctly.

Follow the steps to effectively complete the 3805p Instructions 2018 online.

- Press the 'Get Form' button to access the 3805p Instructions 2018 form. This will allow you to obtain a copy of the form in your preferred editor.

- Begin with Part A, where you will use this form to report any additional tax owed on early distributions from your retirement accounts. Carefully read instructions in this section to ensure accurate reporting.

- In Part B, determine if you are required to file this form based on the specific conditions listed. Check your federal Form 1099-R for the correct distribution codes that apply to your situation.

- Proceed to Part C, which details when and where to file your form FTB 3805P. Ensure you understand the filing deadlines to avoid penalties.

- Move on to Part D to review the definitions of terms used in the form. Familiarizing yourself with these definitions can help clarify any uncertainties regarding the type of distributions you are reporting.

- Complete Part I by entering the amounts of early distributions that are subject to additional tax. Follow the line-by-line instructions carefully for accurate calculation.

- In Part II, report additional tax on certain distributions that may not apply to early distributions. Note the exceptions and verify whether your circumstances fall under any of these categories.

- Complete Part III for any distributions from Archer MSAs and Medicare Advantage MSAs, ensuring compliance with both federal and state regulations.

- After filling out all relevant sections, review your form for any errors or omissions. Once confirmed, you may save, download, or print your completed form for submission.

Ensure you fill out your documents accurately and timely by completing the 3805p Instructions 2018 online.

Contributions for all types of IRAs—Roth, traditional, SEP, and SIMPLE—are reported on Form 5498.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.