Loading

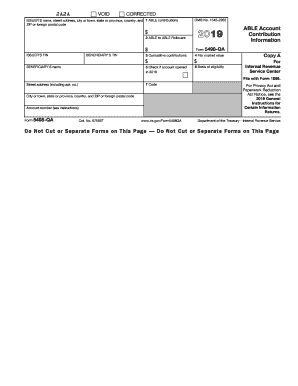

Get 2019 Form 5498-qa. Able Account Contribution Information

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2019 Form 5498-QA. ABLE Account Contribution Information online

Filling out the 2019 Form 5498-QA is an essential step for reporting contributions to an ABLE account. This guide provides clear, step-by-step instructions to assist users in completing the form accurately online.

Follow the steps to fill out the form effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the issuer's name and address in the designated fields, including city or town, state or province, country, and ZIP code.

- Input the monetary amount in Box 1 for contributions made to the ABLE account during 2019.

- Detail any ABLE to ABLE rollovers in Box 2, indicating the amount transferred from another ABLE account.

- In Box 3, reflect the cumulative contributions since the ABLE account was established.

- Provide the fair market value of the ABLE account as of the end of 2019 in Box 4.

- Check the box in Box 5 if the ABLE account was opened in 2019.

- Select the appropriate eligibility basis code in Box 6 based on your circumstances.

- Choose the appropriate code in Box 7 that corresponds to your disability type.

- Review all entered information for accuracy and completeness before saving, downloading, printing, or sharing the form.

Complete and file your 2019 Form 5498-QA online today.

Form 5498 IRA Contribution Information is information for your personal records and is not required to prepare your tax return. Taxpayers should retain this information for their personal records, but there are no tax consequences to the taxpayer until the funds are distributed from the account.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.