Loading

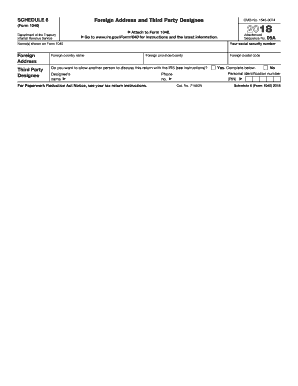

Get Foreign Address And Third Party Designee

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Foreign Address and Third Party Designee online

Filling out the Foreign Address and Third Party Designee section of your tax return is essential for proper communication with the Internal Revenue Service. This guide will help you navigate each component of the form with clarity and ease.

Follow the steps to complete the Foreign Address and Third Party Designee section.

- Press the ‘Get Form’ button to obtain the Foreign Address and Third Party Designee form and open it for editing.

- Locate the section for your social security number at the top of the form and enter the number accurately.

- Find the field labeled 'Name(s) shown on Form 1040' and input the names as they appear on your tax return.

- In the 'Foreign Address' section, provide your foreign address. Begin with the street address, followed by the city, and then enter the foreign province or county.

- Next, specify the foreign country name in the designated field.

- Move to the 'Third Party Designee' section. Here, you will indicate if you want to allow another person to discuss your return with the IRS. Select 'Yes' to proceed.

- If you selected 'Yes,' complete the ‘Designee’s name’ field with the name of the person you are authorizing.

- Next, provide a personal identification number (PIN) for the designee in the corresponding field.

- Lastly, enter the phone number of the designee, ensuring you include the area code.

- After filling out all necessary sections, review your entries for accuracy. You can then save changes, download the form, print it, or share it as needed.

Complete your Foreign Address and Third Party Designee form online today.

Third Party Designee – Designates a person on the taxpayer's tax form to discuss that specific tax return and year with the IRS. Oral Disclosure – Authorizes the IRS to disclose the taxpayer's tax info to a person the taxpayer brings into a phone call or meeting with the IRS about a specific tax issue.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.