Get Canada T1135 E 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T1135 E online

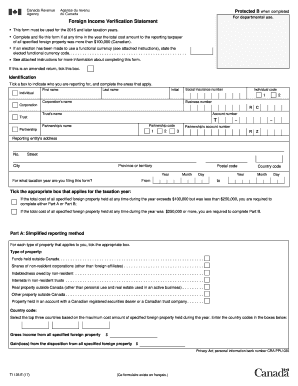

Filing the Canada T1135 E form, also known as the Foreign Income Verification Statement, is essential for individuals and organizations holding specified foreign property exceeding $100,000. This guide will provide you with clear, step-by-step instructions on how to complete this form online, ensuring compliance with Canadian tax regulations.

Follow the steps to fill out the Canada T1135 E correctly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Indicate the relevant identification details by ticking the appropriate box that corresponds to who you are reporting for (individual, corporation, trust, or partnership). Enter your first name, last name, initial, and social insurance number or business number as applicable.

- Specify the taxation year for which you are filing this form by entering the year, month, and day.

- Select the applicable box regarding the total cost of specified foreign property held during the year; indicate if it exceeds $100,000 but is less than $250,000, or if it is $250,000 or more.

- If applicable, complete Part A, which involves simplifying your reporting method by ticking the boxes for each type of specified foreign property you hold, such as funds, shares, or real property outside Canada.

- If you are reporting specified foreign property totaling $250,000 or more, complete Part B. Provide detailed information in the tables for each category of specified foreign property, including maximum cost amounts, income details, and country codes.

- In the certification section of the form, sign and date it, confirming that the information provided is correct and complete. Ensure that this section is filled out by the appropriate individual based on the entity type (e.g., authorized officer for a corporation).

- Once all sections are completed, save changes, download, or print the form for your records. Submit it online as per the filing requirements outlined for individuals or corporations, or mail it to the designated address if you are a trust or partnership.

Begin your online filing of the Canada T1135 E today to ensure compliance with tax regulations.

Get form

To report rental income from a foreign country, you must include it on your Canadian tax return, which may vary depending on the source country. Document all relevant income and expenses and file the Canada T1135 E if required for your foreign properties. Accurate record-keeping helps ensure you comply with tax regulations without facing penalties.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.