Get Canada T1036 E 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T1036 E online

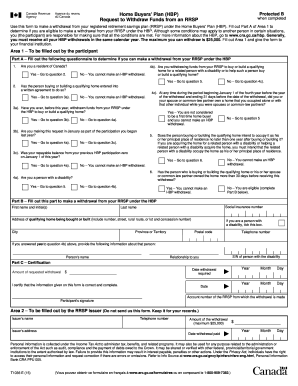

The Canada T1036 E form allows users to request the withdrawal of funds from their registered retirement savings plan under the Home Buyers' Plan. This guide will walk you through the process of completing the form accurately and efficiently, ensuring you meet all requirements.

Follow the steps to complete the Canada T1036 E form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill out Area 1, starting with Part A, which includes a questionnaire. Ensure you address each question to determine your eligibility for a withdrawal under the Home Buyers' Plan.

- In Part A, confirm your residency status in Canada. If the answer is 'No,' you are not eligible for the withdrawal.

- Proceed to question 2 and confirm if you have a written agreement for purchasing or building a qualifying home. If 'No,' you are not eligible.

- Answer question 3a to see if you have previously withdrawn funds under the Home Buyers' Plan. If you have, follow the indicated questions and confirm your first-time buyer status.

- Complete any subsequent questions related to your current application in Part A. Ensure that you have verified each condition thoroughly.

- If eligible, move to Part B and provide the required personal information: your name, social insurance number, address of the property, and contact details.

- If applicable, provide information about the person with a disability if they are the intended homeowner.

- In Part C, certify that the information is correct by providing the date and your signature.

- Finally, review all information for accuracy, then save your changes. You can download, print, or share the completed form as needed.

Begin completing the Canada T1036 E form online today to make your Home Buyers' Plan withdrawal.

Get form

Transferring your RRSP from Canada to the US involves understanding both countries' tax regulations. The Canada T1036 E form is essential for initiating this transfer, as it guides you through the steps necessary to comply with tax rules. It’s advisable to work with professionals who specialize in cross-border finance to ensure a smooth transition. Platforms like uslegalforms provide valuable resources to help you navigate this process effectively.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.