Loading

Get Canada Gst159 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada GST159 online

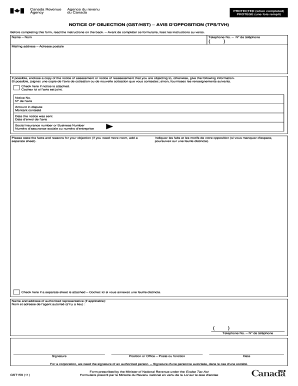

The Canada GST159 is an essential form for individuals who wish to formally object to an assessment or reassessment under the Goods and Services Tax (GST) or the Harmonized Sales Tax (HST). This guide provides comprehensive instructions on how to navigate and complete this form online.

Follow the steps to complete your Canada GST159 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling in your name and telephone number in the designated fields. Ensure your contact information is accurate to avoid any delays in processing your objection.

- Provide your mailing address where correspondence can be sent. Double-check this information for accuracy.

- If applicable, attach a copy of the notice of assessment or reassessment that you are contesting. If you cannot include a copy, make a note in the relevant section.

- In the 'Notice No.' field, enter the number associated with the assessment you are disputing. This number is typically found on the notice you received.

- Specify the amount in dispute by entering the relevant figure in the provided space. This should reflect the amount you're challenging as incorrect.

- Input the date the notice was sent to you. This date is crucial as it helps to establish the timeline for your objection.

- Provide your social insurance number or business number in the specified area. This information is used to identify your account.

- Clearly state the facts and reasons for your objection in the space provided. If you need additional space, be sure to attach a separate sheet.

- If you are including a separate sheet, check the box indicating its inclusion.

- If applicable, fill in the name and address of your authorized representative, along with their telephone number.

- Sign and date the form. If you are submitting on behalf of a corporation, ensure the signature is from an authorized individual.

- Once all fields are complete, review the entire form for accuracy. After verifying all information, save your changes, and you can download, print, or share the form.

Take the next step by completing your Canada GST159 online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Yes, as a Canadian living in the U.S., you are generally required to file a U.S. tax return if you meet certain income thresholds. This requirement helps the IRS assess your tax liabilities fairly. Moreover, knowing how to navigate tax obligations, including those related to Canada GST159, is important for effective financial planning and compliance.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.