Loading

Get Self Certification Form Example

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Self Certification Form Example online

Filling out the Self Certification Form Example is an essential process for entities seeking compliance with the Foreign Account Tax Compliance Act and Common Reporting Standard. This guide offers clear, step-by-step instructions to help users complete the form online with confidence.

Follow the steps to effectively complete the Self Certification Form Example online.

- Click ‘Get Form’ button to access and open the Self Certification Form in the designated online editor.

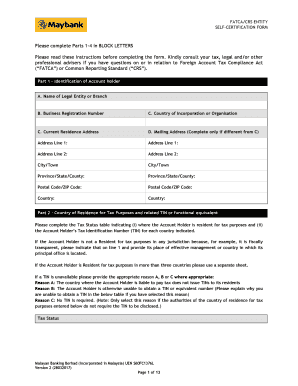

- Complete Part 1: Identification of Account Holder. Fill in the name of the legal entity or branch, business registration number, country of incorporation or organization, and current residence address in block letters. If the mailing address is different from the residence address, provide that information as well.

- Proceed to Part 2: Country of Residence for Tax Purposes. Complete the Tax Status table by indicating the tax residency and the Tax Identification Number for each country. In case of an unavailability of a TIN, select the appropriate reason (A, B, or C) and provide any necessary explanations.

- In Part 3: CRS Status, select the appropriate status by ticking the corresponding box for the account holder. If applicable, provide the Global Intermediary Identification Number.

- Move on to Part 4: FATCA Status. Indicate if the entity is incorporated in the United States, and select the best description for your entity's FATCA status from the provided options A to K.

- Finally, complete Part 5: Declaration and Signature. Ensure that all information provided is accurate and complete, and include names, designations, and signatures of authorized individuals.

- Once you have filled out all required fields and sections, review the information for accuracy. After completing the form, you have options to save changes, download a copy, print, or share the completed form.

Start completing the Self Certification Form Example online today to ensure your compliance with FATCA and CRS requirements.

It's a form you can ask an employee to complete to prove they were absent from work due to illness. It provides a short-term alternative to a sick note from their doctor. Self-certification is only available if the employee is off for seven days or less.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.