Loading

Get Usda Fsa-153 2010-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the USDA FSA-153 online

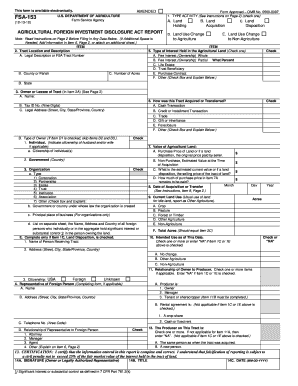

Filling out the USDA FSA-153 form is essential for reporting transactions related to agricultural land. This guide provides clear instructions to help users complete the form accurately and efficiently.

Follow the steps to complete the USDA FSA-153 form online.

- Click ‘Get Form’ button to access the USDA FSA-153 form and open it in your preferred editor.

- Indicate the type of activity by selecting one option from Section 1. Choices include land holding, land acquisition, land disposition, and land use change.

- Provide the tract location and description in Section 2. Enter the legal description or FSA tract number along with the county or parish and the number of acres.

- In Section 3, identify the owner or lessee of the tract by entering their name and tax ID number.

- Detail the type of interest held in the agricultural land in Section 5. Check the appropriate box that reflects either fee interest, life estate, trust beneficiary, purchase contract, or other.

- Complete Section 6, detailing how the tract was acquired or transferred. Options include cash transaction, gift, foreclosure, or other methods.

- In Section 7, list the value of the agricultural land by entering the purchase price and estimated current value, if applicable.

- Specify the date of acquisition or transfer in Section 8, ensuring to use MM-DD-YYYY format.

- Indicate the current land use in Section 9 by checking the appropriate box for crop, pasture, forest, or others.

- Complete Section 10 by indicating the intended use for the land at the time of filing.

- In Section 11, describe the relationship of the owner to the producer, for example, if the producer is the owner, manager, or tenant.

- Certify the accuracy of the information in Section 13 by signing and dating the form where indicated.

- Once all sections are filled out, save your changes, and use the appropriate options to download, print, or share the form as needed.

Complete your USDA FSA-153 form online today to ensure compliance and proper reporting.

FSA and USDA are not the same; rather, FSA operates as a part of the USDA. The USDA oversees a wide range of agricultural programs, while the FSA focuses specifically on serving farmers and ranchers. Understanding their roles can help you utilize the USDA FSA-153 form effectively for your reporting and compliance needs. Knowing the distinction enhances your ability to access agricultural support services.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.