Loading

Get Fb12 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fb12 form online

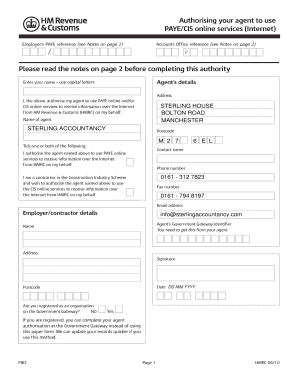

Filling out the Fb12 form online can streamline the process of authorizing your agent to access PAYE and CIS online services on your behalf. This guide provides step-by-step assistance to ensure your form is completed accurately and efficiently.

Follow the steps to complete the Fb12 form online.

- Press the ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Begin by entering your name in capital letters in the designated field for your details.

- Provide your address, making sure to include all necessary information to ensure correct delivery.

- In the section regarding your authorization, clearly state your consent for the agent to access PAYE online and/or CIS online services on your behalf.

- Enter your agent's name in the specified area, ensuring accuracy to avoid any processing issues.

- Fill in your agent's contact details, including the phone number, fax number, and email address, as applicable.

- Complete the employer/contractor details section, providing your PAYE reference and Accounts Office reference as indicated in the notes.

- If you are registered as an organization, indicate this by selecting ‘Yes’ or ‘No’ in the corresponding field.

- Review all entered information for accuracy before signing the form. You should sign and date the form in the spaces provided.

- Once the form is complete and you have saved your changes, download, print, or share it as needed.

Complete your documents online today for a seamless filing experience.

To appoint an agent to deal with your tax, ask them to use HMRC's online authorisation service or complete form 64-8 and send it to HMRC. You can appoint a VAT agent using VAT online services .

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.