Loading

Get Notication Of Dissolution Or Surrender

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Notication Of Dissolution Or Surrender online

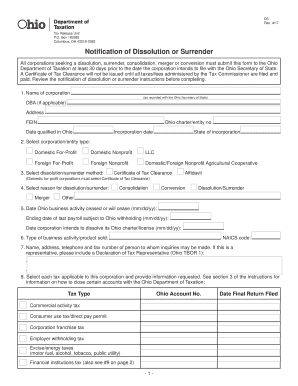

Completing the Notification of Dissolution or Surrender form is an essential step for corporations planning to dissolve, surrender, or convert their business structure. This guide provides clear, step-by-step instructions to help users navigate the form accurately and efficiently.

Follow the steps to complete the form easily

- Press the ‘Get Form’ button to access the Notification of Dissolution or Surrender form online.

- Enter the name of the corporation as it is recorded with the Ohio Secretary of State, along with the Doing Business As (DBA) name, if applicable. Fill in the corporation's address, Federal Employer Identification Number (FEIN), Ohio charter/entity number, date qualified in Ohio, incorporation date, and state of incorporation.

- Select the type of corporation/entity you are filing for from the provided options, including various categories such as Domestic For-Profit, Domestic Nonprofit, LLC, and others.

- Choose the applicable method for dissolution or surrender, opting between a Certificate of Tax Clearance or Affidavit, noting that domestic for-profit corporations must select the Certificate of Tax Clearance.

- Indicate the reason for the dissolution or surrender by selecting from options such as merger, consolidation, conversion, or other specific reasons.

- Provide the date when the Ohio business activity ceased or is expected to cease, along with the ending date of the last payroll subject to Ohio withholding and the intended date for the dissolution.

- Detail the type of business activity or product sold, providing the corresponding NAICS code for your business.

- Supply the name, address, telephone, and fax number of the person to whom inquiries may be addressed. If applicable, include a Declaration of Tax Representative.

- Select each tax applicable to the corporation and enter the requested information, referencing section 3 of the instructions to correctly close each account with the Ohio Department of Taxation.

- If applicable, provide details regarding the financial institution tax if filed as part of a group, including the reporting member's name and FIT account number.

- List the name, address, FEIN, and Ohio charter/license number of any entity continuing the business activities of the dissolving corporation.

- Note any pending matters with the Ohio Department of Taxation, like petitions for reassessment or appeals to the Board of Tax Appeals.

- Identify the individual and mailing address for the Certificate of Tax Clearance, ensuring it is distinct from the previous response if necessary.

- Document each officer's and director's name, address, and Social Security number (SSN), appending additional lists as needed.

- Review and confirm that the statements in the form are accurate, signing it as an officer of the corporation or an individual executing the dissolution. Include the name, title, and date of signing.

- Upon completing the form, save the changes, and choose your preferred method to submit the form, either through online submission, via email, or postal mail.

Complete the Notification of Dissolution or Surrender form online today to streamline your corporate dissolution process.

Filing Instructions Articles of Dissolution will voluntarily dissolve the Florida corporation. Once filed, the entity will no longer exist. The online filing form is basic and meets the minimum filing requirements pursuant to s.607.1401, 607.1403, 617.1401, and 617.1403, F.S.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.