Loading

Get Emac Employee Information Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Emac Employee Information Form online

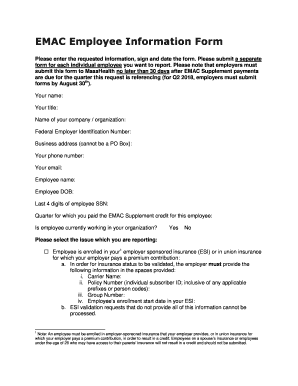

Filling out the Emac Employee Information Form online is essential for employers to report employee information related to EMAC Supplement payments. This guide will assist you in navigating each section to ensure accurate and complete submissions.

Follow the steps to successfully complete the Emac Employee Information Form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your name in the designated field to identify yourself as the provider of this information.

- Input your title to clarify your role within the organization.

- Provide the official name of your company or organization to ensure proper attribution of the form.

- Enter the federal employer identification number, ensuring this is accurate to prevent delays in processing.

- Fill in the business address, noting that it must not be a P.O. Box, as this is required for official communication.

- Include your phone number for any follow-up communication regarding the form.

- Input your email address to receive confirmations or additional correspondence related to the submission.

- State the employee’s name in the required section to report on the specific individual.

- Enter the employee’s date of birth to verify their identity and eligibility.

- Provide the last four digits of the employee's social security number to assist with their identification.

- Indicate the quarter for which you are reporting the EMAC Supplement credit payment for this employee.

- Specify whether the employee is currently working in your organization by selecting 'Yes' or 'No.'

- Choose the issue you are reporting from the provided options that best describes the employee’s situation.

- Depending on the selected issue, provide the necessary details in the provided sections, including carrier name, policy number, and group number for employer-sponsored insurance, or attach documentation for residency or income discrepancies.

- Use the description space to clarify any additional information or evidence you are submitting alongside the form.

- Review the information for accuracy, ensuring that all fields are completed as required.

- Once all sections are filled, sign and date the form to certify accuracy under penalty of perjury.

- Submit the completed and signed form along with any necessary attachments by secure email to EMACemployeedata@State.MA.US.

Complete the Emac Employee Information Form online today to ensure timely reporting and compliance.

The employer medical assistance contribution tax is an employer-only tax Massachusetts employers with six or more employees pay. EMAC is a percentage of each employee's wages. Massachusetts employers must file and report their quarterly EMAC tax liability to the Department of Unemployment Assistance (DUA).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.