Loading

Get Tc 20r

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Tc 20r online

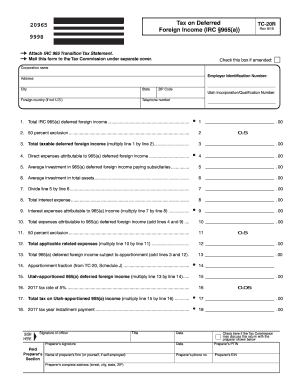

The Tc 20r form is essential for calculating taxes on deferred foreign income for the 2017 tax year. This guide provides clear, step-by-step instructions for filling out the form accurately and efficiently.

Follow the steps to complete the Tc 20r form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the corporation name and the Employer Identification Number (EIN) in the designated fields.

- Provide the complete address of the corporation, including city, state, and ZIP code.

- If applicable, enter the foreign country of incorporation, along with the telephone number.

- Input the Utah Incorporation/Qualification Number.

- Fill in line 1 with the total deferred foreign income from the IRC 965 Transition Tax Statement, which you should have available.

- For line 2, enter the percentage for the 50 percent exclusion.

- On line 3, calculate the total taxable deferred foreign income by multiplying line 1 by line 2.

- Record any direct expenses attributable to 965(a) deferred foreign income on line 4.

- Determine the average investment in 965(a) deferred foreign income paying subsidiaries and enter it on line 5.

- On line 6, enter the average investment in total assets calculated from your consolidated balance sheet.

- Divide line 5 by line 6 to find the relevant fraction and enter it on line 7.

- Input your total interest expense on line 8.

- Calculate the interest expenses attributable to 965(a) income by multiplying line 7 by line 8 and enter the result on line 9.

- Add lines 4 and 9 together for total expenses attributable to 965(a) deferred foreign income and enter this on line 10.

- Enter 50 percent on line 11 for the exclusion.

- Multiply line 10 by line 11 to get total applicable related expenses for line 12.

- Add lines 3 and 12 to determine the total 965(a) deferred foreign income subject to apportionment for line 13.

- Input the apportionment fraction as found in TC-20 Schedule J on line 14.

- Calculate the Utah-apportioned 965(a) deferred foreign income for line 15 by multiplying line 13 by line 14.

- On line 16, enter the 2017 tax rate of 5 percent.

- Determine the total tax on the Utah-apportioned 965(a) income by multiplying line 15 by line 16 for line 17.

- If applicable, enter the 2017 tax year installment payment amount on line 18.

- Ensure all required signatures are present in the designated areas, including those of the officer and preparer.

- Once all fields are completed, save your changes, and prepare to download, print, or share the form as needed.

We encourage you to complete and submit your documents online for a more efficient filing process.

Current Forms NumberOrdering NumberTax TypeTC-40 FormsTC-0040Individual IncomeTC-40 InstructionsTC-0040 InstructionsIndividual IncomeTC-40 Mini PacketTC-0040 miniIndividual IncomeTC-40 Full PacketTC-0040 packetIndividual Income48 more rows

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.