Loading

Get How To Get A Fillable Cra T1135 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the How To Get A Fillable Cra T1135 Form online

Filling out the CRA T1135 form online can seem daunting, but with the right guidance, you can complete it confidently and accurately. This guide will provide you with step-by-step instructions to help you navigate through the form easily.

Follow the steps to successfully complete the form online.

- Click the ‘Get Form’ button to obtain the form and open it in your editor.

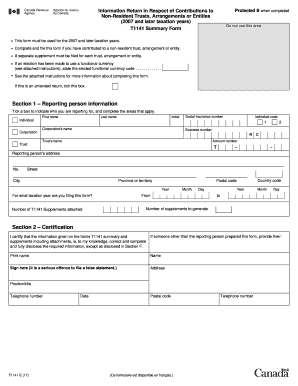

- Select the appropriate box to identify whether you are reporting for an individual, corporation, or trust. Fill in the required reporting person information, including first name, last name, social insurance number, and address.

- Indicate the taxation year for which you are filing the form by filling in the relevant year and dates.

- In Section 2, certify that the information provided is accurate and complete. If someone else prepared the form on your behalf, provide their details as well.

- In Section A of the T1141 Supplement, identify the trust, arrangement, or entity by providing its name, account number, and country details.

- Complete Section B with details about the decision-makers for the trust or entity, including names, addresses, and any necessary consultation requirements.

- Fill out Section C with details about the settlors and Section D with the necessary information about beneficiaries.

- In Section E, report all contributions and distributions associated with the trust, including fair market values and descriptions.

- If applicable, complete Sections F and G detailing any due diligence exceptions and necessary attachments.

- Once all sections are filled out accurately, save your changes, download the form, and print or share as needed.

Start completing your T1135 form online to ensure timely and accurate filing.

Is the 5% penalty for failing to file Form T1135 levied per year? The 5% penalty is levied when the failure to file for a year is done knowingly or under circumstances amounting to gross negligence.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.