Loading

Get Indian Income Tax Return Verification Form - K S D & Associates

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Indian Income Tax Return Verification Form - K S D & Associates online

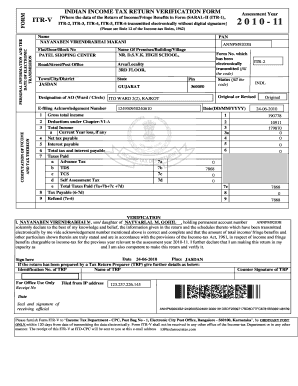

Filling out the Indian Income Tax Return Verification Form is an essential step for individuals who wish to ensure their income tax return is processed accurately. This guide provides a straightforward approach to completing the form online, making it accessible for all users, regardless of their legal expertise.

Follow the steps to successfully complete the form online:

- Press the ‘Get Form’ button to access the form and open it for editing.

- Fill in the assessment year. Ensure that the year pertains to the financial year for which you are filing the return.

- Enter your personal details, including your name and PAN (Permanent Account Number). It is crucial to ensure these details match the information on your official documents.

- Provide your address details, including flat number, premises name, and locality. Make sure to include the state and pin code accurately.

- Indicate the form number which has been electronically transmitted and specify if it is an original or revised return.

- Fill out details regarding your gross total income and any deductions under Chapter VI-A. These figures should reflect your financial status for the assessment year.

- Calculate your total income and any net tax payable, including any interest payable.

- List any taxes paid, such as advance tax, TDS, TCS, and self-assessment tax.

- Compute the total taxes paid and ascertain any refund owed to you.

- In the verification section, declare that the information entered is accurate to the best of your knowledge. Enter your details and sign the form.

- Finally, save your changes, download a copy of the completed form, and prepare it for submission by ordinary post to the specified address.

Complete your documents online to ensure a smooth filing process.

Step 1: Go to the e-Filing portal homepage. Step 2: Click Income Tax Return (ITR) Status. Step 3: On the Income Tax Return (ITR) Status page, enter your acknowledgement number and a valid mobile number and click Continue. Step 4: Enter the 6-digit OTP received on your mobile number entered in Step 3 and click Submit.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.