Loading

Get Bir56a

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Bir56a online

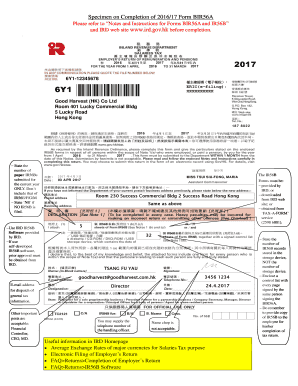

Filling out the Bir56a form is an essential process for employers in managing their tax responsibilities. This guide will walk you through each section of the form, ensuring a smooth and efficient completion.

Follow the steps to complete the Bir56a online effortlessly.

- Use the ‘Get Form’ button to access the Bir56a form. By pressing this button, you will obtain the form and have it ready for editing.

- Begin by entering the employer’s details, including the name and address. Ensure accuracy as this information is vital for identification purposes.

- In the relevant section, state the number of paper IR56Bs submitted for the current year only. If no IR56B forms are filed, indicate ‘Nil’.

- If you are using the IRD’s IR56B software, ensure it is the approved version. If using a self-developed software, prior approval from the IRD is mandatory.

- Fill in the information for the officer handling the form, including their name, title, and contact details. Avoid using a name chop, as it is not acceptable.

- Confirm the number of IR56B records stored in your storage device. Only report the number of records, not the number of storage devices.

- Attach a control list for each page of the Bir56a, signed by the individual who is also signing the form itself.

- Before finalizing, remember to provide copies of the IR56B to the respective employees for their tax return completion.

- Lastly, save your changes, and you may choose to download, print, or share the completed form as needed.

Complete your Bir56a online today to ensure compliance with tax regulations.

Income to be reported. (a) Salaries Tax is charged on employment income arising in or derived from Hong Kong which includes income derived from services rendered in Hong Kong and remuneration paid to an employee under certain service company arrangements.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.