Loading

Get Questionnaire On Cooperative Banks

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Questionnaire On Cooperative Banks online

This guide provides step-by-step instructions for filling out the Questionnaire On Cooperative Banks. Designed to assist users of all experience levels, it ensures you can complete the form accurately and effectively.

Follow the steps to complete the Questionnaire On Cooperative Banks online.

- Press the ‘Get Form’ button to access the Questionnaire On Cooperative Banks. This action will allow you to retrieve and open the document in a suitable editor.

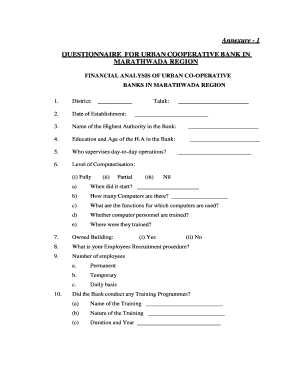

- Begin filling in the form by entering the required information about your district and the date of establishment of your cooperative bank. For the district, provide the specific area name; for the date of establishment, input the complete date as accurately as possible.

- Provide the name of the highest authority within the bank and include their educational background and age. Ensure that you fill this section accurately, as it is crucial for verifying the bank’s governance.

- Indicate who supervises the day-to-day operations of the bank, detailing the supervision structure. This may involve naming specific positions or roles.

- Complete the section about the level of computerization at your bank. Select between fully, partially, or not computerized, and answer the sub-questions regarding the initiation of computer use, number of computers, functions performed by computers, training status of personnel, and their training locations.

- Describe your bank's building status by indicating whether it is owned or leased. This is essential to understand the bank's asset management.

- Explain your employees' recruitment procedures and specify the numbers of permanent, temporary, and daily basis employees.

- Detail the training programs conducted by the bank, including the name, nature, duration, and year of the training.

- In the loans section, outline the various nature and purposes of loans issued over the past ten years.

- Indicate how lending rates are determined and identify who is responsible for setting these rates. Include specifics about existing borrowing and lending rates.

- Provide information about membership particulars and growth over the last ten years. This helps gauge the bank's outreach and customer base expansion.

- Discuss how dividends are distributed among members of the bank.

- Detail the assets and liabilities of the bank for the past five years to provide a comprehensive financial overview.

- List the administrative costs associated with your bank's operations, including salaries, maintenance, and other related expenses.

- Identify reasons for non-performing assets (NPA) and provide insights into potential interest rate impacts.

- Complete the section that details employee designations, qualifications, and duties to ensure a thorough overview of the workforce.

- Submit details regarding board of directors, including names, ages, designations, and their involvement with the bank.

- Answer questions regarding government representatives' participation in meetings and their responsibilities.

- Provide insights into recent operational changes within the bank and any competition faced from commercial banks.

- After filling out all required sections, save your changes. You can also download, print, or share the completed Questionnaire as needed.

Complete your Questionnaire On Cooperative Banks online today for a streamlined submission process.

Cooperatives are people-centred enterprises owned, controlled and run by and for their members to realise their common economic, social, and cultural needs and aspirations. Cooperatives bring people together in a democratic and equal way.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.