Loading

Get Ak Charitable Organization Annual Registration Form 2007-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AK Charitable Organization Annual Registration Form online

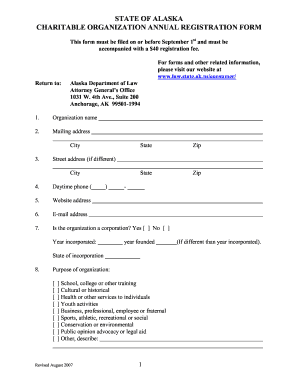

Completing the AK Charitable Organization Annual Registration Form is essential for organizations wishing to operate legally in Alaska. This guide provides a clear, step-by-step process to assist you in filling out the form accurately and efficiently.

Follow the steps to successfully complete the registration form

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the organization name in the designated field. This should be the official name of your charitable organization as recognized by the state.

- Provide the mailing address along with the city, state, and zip code. If there is a different street address, include that as well.

- Input the daytime phone number, ensuring that the area code is included.

- Enter the website address for your organization, if applicable.

- Fill in the e-mail address where correspondence can be sent.

- Indicate whether the organization is a corporation by selecting 'Yes' or 'No' and provide the year incorporated and the state of incorporation.

- Check the box that best describes the organization's purpose from the provided options, or select 'Other' and describe it.

- Summarize the organization's programs and activities that support its stated purposes in the appropriate field.

- Describe how a citizen can verify or observe the organization's activities.

- List any other names under which contributions will be solicited.

- Provide the names and titles of three officers or employees who receive the greatest compensation from the organization.

- Attach a list of names, addresses, and telephone numbers of officers unless you have indicated that the state of Alaska non-profit corporation registration is current.

- Indicate the number of expected solicitation campaigns during the registration period.

- List any paid solicitors under contract to provide fundraising services during this registration period, along with their details.

- Select whether your organization has applied for federal tax-exempt status and check the applicable boxes.

- Check the relevant form numbers of returns filed with the Internal Revenue Service for the most recent fiscal year.

- If applicable, attach the most recently completed Form 990 and/or the audited financial report.

- Complete the financial report for the accounting year, providing gross revenue, expenses, and other relevant financial details.

- Indicate whether the organization paid for fundraising services of outside entities and provide the details.

- Ensure that the registration fee is submitted with the form, and certify the information by signing and dating the form.

- Once all fields are completed, save changes, download the form, print it, or share it as needed.

Complete your registration form online today to ensure compliance and support your charitable mission.

Forming a charitable organization involves several steps, including defining your mission, drafting bylaws, and registering with the state. Begin by filling out the AK Charitable Organization Annual Registration Form, as this is a key requirement in Alaska. Platforms like USLegalForms offer resources and guidance to streamline your formation process, ensuring compliance and clarity.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.