Get Va Vec-fc-27 2009-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VA VEC-FC-27 online

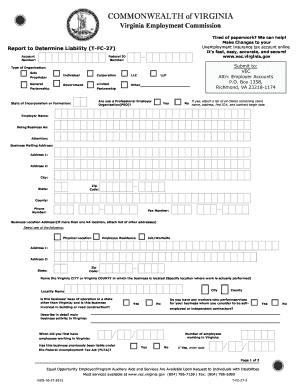

The VA VEC-FC-27 form is essential for businesses operating in Virginia to establish an account with the Virginia Employment Commission. This guide provides clear, step-by-step instructions to help you navigate and complete the form online accurately.

Follow the steps to successfully complete the form.

- Click 'Get Form' button to obtain the VA VEC-FC-27 and open it in your browser.

- Enter your Federal ID No. (xx-xxxxxxx) in the designated field.

- Select the type of organization from the list provided, indicating whether you are a sole proprietorship, partnership, corporation, or other.

- Fill in your email address and complete the contact information, including the name of the employer, trade name, telephone number, and mailing address.

- Provide the Virginia business location address and zip code. If your business has multiple locations, attach a list of other addresses.

- Indicate whether your business has a base of operations outside of Virginia by selecting 'Yes' or 'No.'

- Enter the date when you first had employees in Virginia, along with the number of employees. If your business is inactive, provide the date employment ceased.

- Answer the question regarding whether you employ individuals that you do not consider employees.

- If applicable, provide details regarding your domestic, agricultural, or general employer payroll levels.

- Indicate if your organization is exempt from Tax under the relevant Internal Revenue Code sections, and attach the exemption letter if applicable.

- If you have acquired a business in Virginia, provide necessary information about the acquisition.

- Describe the kind of business in Virginia and specify the nature of the services offered.

- Provide the name of the Virginia city or county where your business operates.

- List the names, Social Security Numbers, and addresses of owners, partners, or corporate officers.

- Certify that the information provided is accurate and sign the form.

- Save the completed form, and choose to download, print, or share it as needed.

Complete your VA VEC-FC-27 form online today for a smooth filing process.

In Virginia, disqualifications for unemployment can often stem from specific actions or circumstances. For example, if you refuse suitable work offers or do not meet the work search requirements, you could be disqualified. Understanding the nuances of these regulations, particularly those outlined in VA VEC-FC-27, can greatly impact your claim. Using resources from uslegalforms can assist in navigating these rules effectively.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.