Loading

Get Or Monthly Report

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OR Monthly Report online

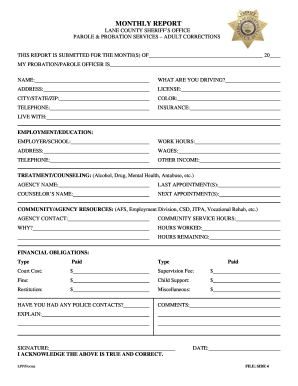

The OR Monthly Report is an important document for individuals under parole or probation services. Completing this report accurately is essential for maintaining compliance and staying informed about your progress.

Follow the steps to fill out the OR Monthly Report.

- Click ‘Get Form’ button to access the report and open it in the editor.

- Enter the month(s) for which you are submitting the report in the provided field. Ensure the dates are accurate and complete.

- Fill in the name of your probation/parole officer in the designated section. This ensures your report reaches the appropriate person.

- Provide details about your vehicle. Include what you are driving, including the address, license plate number, city, state, zip code, color, and your contact number.

- Input information regarding your insurance in the relevant section. This is crucial for verifying that you have active coverage.

- Detail your living situation, including your employment or education. Enter the name of your employer or school, work hours, and contact details.

- Indicate your wages and any additional income you receive. This helps to provide a complete picture of your financial situation.

- Provide information about any treatment or counseling you are currently receiving. Include the agency name, last appointment date, counselor’s name, and the next appointment date.

- List any community or agency resources you are utilizing and the agency contact information. This section can aid in demonstrating your proactive approach.

- Document your community service hours. Specify how many hours you have worked and how many hours remain.

- Outline your financial obligations by specifying the types of obligations and indicating whether they have been paid. Include all necessary details for each type.

- Report any police contacts you have experienced during the reporting period. Include any relevant comments or explanations.

- Sign and date the report, affirming that the information provided is true and correct.

- After completing all sections, save your changes, and choose to download, print, or share the form as needed.

Complete your OR Monthly Report online today to ensure timely submission.

Receiving a tax refund on an income less than $10,000 depends on tax withholdings and credits that may apply. If your earnings were too low for tax liability, you might still qualify for refundable credits. Keep your OR Monthly Report close to understand how your income and withholdings interact for potential refunds.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.