Get Tx 11200-c3 2011-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

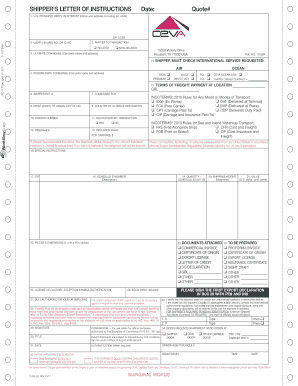

How to fill out the TX 11200-C3 online

Filling out the TX 11200-C3 form online may seem daunting, but with clear guidance, it can be a straightforward process. This guide will walk you through each section and field of the form, ensuring you understand what is required for accurate completion.

Follow the steps to fill out the TX 11200-C3 form online.

- Press the ‘Get Form’ button to access the TX 11200-C3 form and open it in your preferred online editor.

- Fill in the 'U.S. principle party in interest' section with the complete name and address, ensuring to include the ZIP code for accuracy.

- Enter the 'USPPI EIN (IRS) No. or ID No.' if applicable. This is important for identification purposes.

- Indicate the type of transaction by selecting whether the parties involved are related or non-related.

- Complete the 'ultimate consignee' section by providing the full name and address of the final recipient, including country and ZIP code.

- Specify the 'intermediate consignee' details if applicable. Ensure all information is accurate to avoid delivery issues.

- Choose the shipping method by checking the box for air or ocean transport, depending on your shipment.

- Fill in 'point (state) of origin or FTZ No.' to indicate where the shipment originates.

- Provide the 'country of ultimate destination' in this required field.

- Insert the 'in bond number' if this pertains to your shipment.

- Select the appropriate incoterms that apply to your transaction for both international and sea/inland transport.

- Declare the value for carriage and ensure that if insurance is requested, it is clearly indicated.

- Check the appropriate options for the documents that accompany your shipment, such as commercial invoices or certificates of origin.

- Provide any special instructions in section 16 to clarify any specific shipping requests.

- Sign the document in box 29, ensuring your signature is in pen and ink as required.

- Review all entries for accuracy before saving changes to the form.

- Once completed, download, print, or share the TX 11200-C3 form as needed for your records.

Start completing your TX 11200-C3 form online today for hassle-free document management.

Related links form

Obtaining a penalty waiver for late filing of franchise taxes in Texas typically requires you to file the TX 11200-C3 form along with a request for relief. You must demonstrate reasonable cause for your late filing to qualify for the waiver. Utilizing platforms like USLegalForms can simplify this process by providing you with the appropriate templates and guidance you need to successfully submit your request.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.