Get Ca Calstrs Rf1360 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA CALSTRS RF1360 online

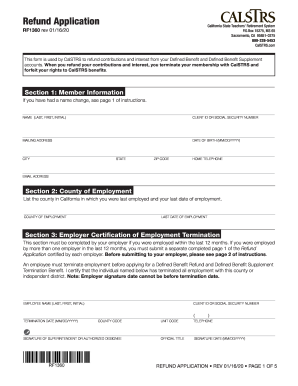

Filling out the CA CALSTRS RF1360 form for refunding your contributions is an essential process. This guide provides a step-by-step approach to ensure you complete the form accurately and efficiently, maximizing your chance for a timely refund.

Follow the steps to complete your CA CALSTRS RF1360 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Complete Section 1: Member Information. Provide your full name, Client ID or Social Security number, mailing address, date of birth, telephone number, and email address. Ensure the information matches your Social Security card.

- In Section 2: County of Employment, specify the county where you were employed and your last day of employment.

- Section 3 requires your employer to certify your employment termination if applicable. Ensure this section is filled out correctly by your employer.

- Proceed to Section 4: Defined Benefit Payment Instructions. Choose between a direct payment or a rollover option for your Defined Benefit refund.

- Fill out Section 4.2 for defined benefit rollover. Provide the financial institution details including account information and obtain any necessary signatures.

- Section 5 covers Defined Benefit Supplement Payment Instructions. Indicate your choice for distribution similar to Section 4.

- In Section 6, specify your tax withholding preferences. Decide whether to withhold California state income tax or opt-out.

- Section 7: Required Signatures mandates all necessary signatures indicating your marital status and the signatures of any required parties. Ensure accuracy.

- Review the Refund Application Checklist to verify you did not miss any necessary steps before submitting your application for processing.

- Once completed, save your changes. You can download, print, or share the form as needed.

Get started on your CA CALSTRS RF1360 application online today!

Related links form

You can access your CA CALSTRS RF1360 benefits when you reach retirement age, which is typically 55 for most members. Additionally, if you separate from service before retirement age, you may still have options for accessing your funds under certain circumstances. Timing can significantly impact your benefits and what you receive. For more personalized guidance on accessing your CalSTRS benefits, consider exploring the resources available through US Legal Forms.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.