Loading

Get Ftb 3532

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ftb 3532 online

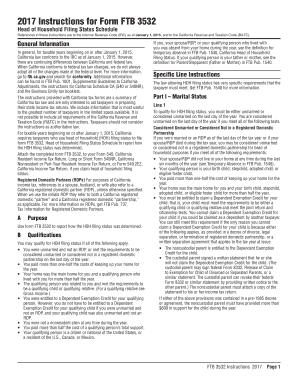

Filling out the Ftb 3532, Head of Household Filing Status Schedule, is an essential step for claiming the head of household status on your California tax return. This guide provides clear, step-by-step instructions to assist you in completing the form accurately and efficiently online.

Follow the steps to correctly fill out the Ftb 3532 online

- Click ‘Get Form’ button to access the form and open it in your preferred online editor.

- In Part I, indicate your marital status. Ensure you meet the criteria for being considered unmarried or not in a registered domestic partnership on the last day of the year.

- Complete Part II by noting your qualifying person's details. Confirm that the qualifying person has lived with you for more than half the year, counting at least 183 days.

- In Part III, provide the qualifying person's name, social security number, and date of birth. Double-check the SSN for accuracy against their social security card.

- Ensure you note the gross income of your qualifying person, verifying that it is below the eligible limit for the tax year, and include any necessary documentation if applicable.

- Once the form is completed, review all provided information for accuracy. Save any changes made to the document. You may then choose to download, print, or share the form as necessary.

Complete your Ftb 3532 online today to ensure a smooth filing process!

The Franchise Tax Board will send a notice or letter for issues that may include but not limited to: You have a balance due. You are due a larger or smaller refund. We need to notify you of delays in processing your return.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.