Loading

Get It 2105

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the It 2105 online

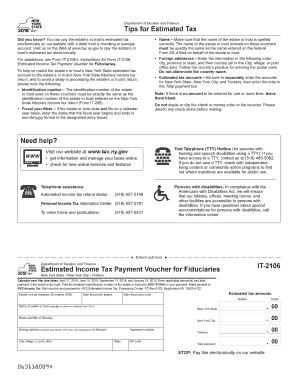

Filling out the It 2105 form online is a straightforward process that allows users to manage estimated tax payments for estates and trusts efficiently. This guide provides step-by-step instructions to help ensure accurate completion of the form and timely submission.

Follow the steps to successfully complete the It 2105 form online.

- Click the ‘Get Form’ button to access the It 2105 document and open it in your preferred editor.

- Begin by entering the identification number of the estate or trust at the top of the form. This number must match exactly with that on the New York State fiduciary income tax return (Form IT-205).

- Specify the name of the estate or trust. Ensure it is spelled correctly and corresponds with the name filed on the federal Form SS-4.

- If applicable, enter the dates for the fiscal year. Input the start and end dates in mm-dd-yyyy format in the designated areas.

- Complete the estimated tax amounts section by entering the figures for New York State, New York City, and Yonkers separately. Make sure to also enter the total payment amount in the provided box.

- Note that if there is no amount for a certain category, you should leave those fields blank.

- Double-check all entries for accuracy and completeness before moving on.

- Save your changes to the form, and look for options to download, print, or share the completed It 2105 form as needed.

Complete your documentation online to ensure a smooth and efficient filing process.

Form IT-2105.9 Underpayment of Estimated Income Tax By Individuals and Fiduciaries Tax Year 2022.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.