Loading

Get Gains Withholding Clearance

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Gains Withholding Clearance online

This guide provides step-by-step instructions for completing the Gains Withholding Clearance form online. Whether you are a first-time user or need a refresher, this comprehensive overview will help ensure that your application is filled out correctly and submitted efficiently.

Follow the steps to correctly complete the Gains Withholding Clearance form.

- Click ‘Get Form’ button to obtain the Gains Withholding Clearance form. Make sure to have the form ready to open and edit in your preferred digital format.

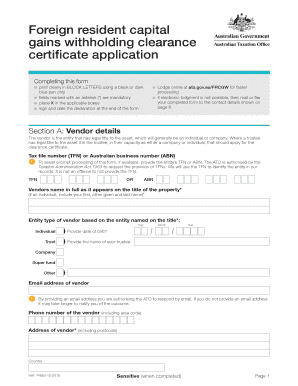

- Begin with Section A: Vendor details. Enter the vendor's name as it appears on the title of the property, ensuring to include all given and last names as necessary. Provide the vendor's tax file number (TFN) or Australian business number (ABN) if available, as well as their contact email and phone number.

- Continue to Section B: Transaction dates. Carefully input the contract date and the expected settlement date of the asset. These dates are crucial for processing your application.

- Move to Section C: Contact person. If you are completing the form on behalf of the vendor, provide your full name and contact details, including email and phone number.

- In Section D: Clearance certificate application questions, answer all three mandatory questions accurately. Based on your responses, you may need to complete additional sections (E, F, G, or H) regarding your entity type.

- If the vendor is an individual, complete Section E with the required questions regarding residency status, duration of stay in Australia, and details about dependent family members.

- For vendors classified as a company, proceed to Section F. Provide information on the company’s incorporation status and its operations within Australia.

- If the vendor is a trust, fill out Section G with the relevant details about the trust's structure and operations.

- For super funds, complete Section H, which requires information specific to Australian Superannuation Funds, including management and control locations.

- In Section I: Declaration, ensure that the person authorized to provide the information signs and dates the form, confirming that all information is true and correct. Incomplete forms may delay processing.

Complete your Gains Withholding Clearance application online today for a faster processing experience.

What is an ATO Clearance Certificate? The ATO may issue an ATO Clearance Certificate (also called Certificate of Clearance) stating that the vendor of taxable Australian real property or an indirect Australian real property company title interest is not a relevant foreign resident.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.