Loading

Get Dr-309634

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DR-309634 online

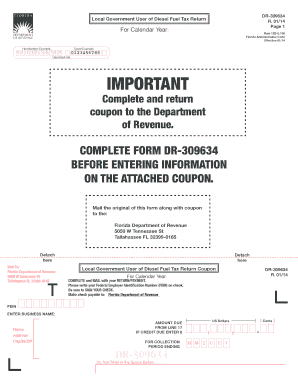

This guide provides clear, step-by-step instructions for completing the DR-309634 form, specifically tailored for local government users of diesel fuel. Whether you are filling it out for the first time or require clarification on specific sections, this guide aims to support you in the process.

Follow the steps to accurately complete the DR-309634 form.

- Press the ‘Get Form’ button to obtain the DR-309634 form and open it in your browser or digital editor.

- Begin by filling in the 'For Calendar Year' section at the top of the form. Clearly indicate the year for which you are filing the tax return.

- Provide your Federal Employer Identification Number (FEIN) in the designated field. Ensure this number is accurate to avoid processing delays.

- Complete the fields for your business name, address, city, state, and ZIP code as requested. Make sure this information is current and correctly formatted.

- In the section titled 'Return Due By,' write the specific date by which your submission must be made.

- Fill out the section regarding diesel fuel tax due following the provided formulas carefully, including calculating any applicable credits.

- Review the net tax due calculation to ensure accuracy before proceeding. This step is critical to avoid penalties.

- Include any necessary adjustments for penalties and interest if applicable, as outlined in the form.

- Sign and date the form where indicated. Ensure that the person submitting the form has the authority to do so.

- Finally, save any changes made to the form. You can choose to download, print, and share the completed DR-309634 form with the Florida Department of Revenue by mailing it to the specified address.

Complete your documents online for efficiency and accuracy.

A 1-cent gas tax (Ninth Cent Gas Tax) is levied by the County per F.S. Section 336.021 on each gallon of motor and diesel fuel sold, as adopted in 1993 by the Board of County Commissioners.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.