Loading

Get Mi L-3 2010-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI L-3 online

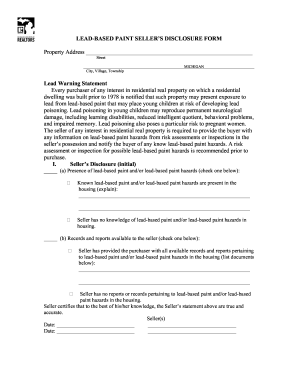

The MI L-3 form is essential for documenting potential lead-based paint hazards in properties built before 1978. This guide will help you navigate the process of filling out this important form online, ensuring compliance and safety for all parties involved.

Follow the steps to complete your MI L-3 form online.

- Press the ‘Get Form’ button to access the MI L-3 document and open it in your preferred online editor.

- Begin by entering the property address, including the street, city, village, and township in the designated fields.

- Read the lead warning statement carefully. This section highlights the risks associated with lead exposure, especially for children and pregnant individuals.

- In Section I, seller’s disclosure, check the box that accurately reflects your knowledge of the presence of lead-based paint hazards. If applicable, provide detailed explanations in the available space.

- Next, indicate whether you have any records or reports regarding lead-based paint hazards. If you do, list all documents provided to the purchaser.

- Sellers must date and sign the form, certifying that the provided information is true and accurate.

- In Section II, the agent’s acknowledgment section, the agent must confirm they have informed the seller of their obligations and also sign and date this section.

- Finally, move to Section III for purchaser’s acknowledgment. Here, purchasers confirm they have received all necessary information and the federally approved pamphlet on lead safety.

- In this section, purchasers also indicate whether they have waived or accepted a risk assessment opportunity. Ensure to date and sign this section.

- Once all sections are completed, you can save your changes, download a copy, print the form, or share it as needed.

Complete your MI L-3 form online today for a safer property transaction!

Yes, in Michigan, employers have a responsibility to withhold local taxes as mandated by local ordinances. These withholdings are crucial as they ensure that employees meet their local tax obligations through payroll deductions. Familiarity with the MI L-3 form can aid employers in correctly fulfilling this duty. For detailed templates and assistance, check out USLegalForms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.