Get In State Form 43709 2015-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IN State Form 43709 online

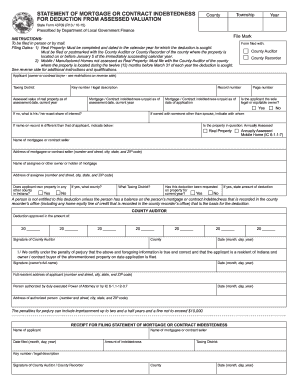

Filling out the IN State Form 43709 is an essential step for individuals seeking a deduction from their assessed property valuation due to mortgage or contract indebtedness. This guide provides step-by-step instructions to assist users in completing the form accurately and efficiently online.

Follow the steps to fill out the IN State Form 43709 online.

- Click ‘Get Form’ button to obtain the form and access it in the online editor.

- Begin by entering the township and county where the property is located. These fields are crucial for identifying the relevant jurisdiction.

- Fill in the applicant's details. This could be the owner or contract buyer. Ensure that the information is accurate and complete.

- List the mortgage or contract indebtedness unpaid as of the assessment date and the date of application. These figures are vital for the deduction eligibility.

- Complete the sections regarding whether the property is annually assessed real property or a mobile home, and provide details about the mortgagee or contract seller.

- If a deduction was requested for the current year, specify the amount. This is crucial for the deduction evaluation process.

- Review all entered information for accuracy. Once confirmed, users can save the changes, download the completed form, or print and share it as necessary.

Complete your IN State Form 43709 online today to ensure your application is filed on time.

Filling out Form 8829 involves providing details about the total expenses, the portion of your home used for business, and any related deductions. Begin by ensuring you have records of your home expenses and the square footage calculation. With resources like the IN State Form 43709, you can efficiently complete this form while also staying compliant with regulations.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.