Loading

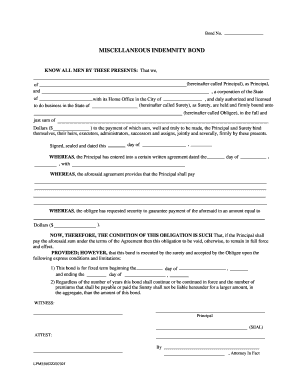

Get Miscellaneous Indemnity Bond

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MISCELLANEOUS INDEMNITY BOND online

The MISCELLANEOUS INDEMNITY BOND is an important document that serves to guarantee payment obligations in various agreements. This guide will walk you through the steps to effectively complete this bond online, ensuring that you understand each component for your specific needs.

Follow the steps to complete your bond online successfully.

- Press the ‘Get Form’ button to obtain the MISCELLANEOUS INDEMNITY BOND and open it for editing.

- In the first section, input the name of the Principal and any identifying information required, such as their business structure and location.

- Next, provide the name of the Surety, indicating the corporation and state of incorporation. Ensure the Home Office city is also specified.

- Detail the Obligee's name, which is the entity requesting the indemnity bond, along with the necessary payment amount in dollars.

- Fill in the specific monetary sum to which the Principal and Surety bind themselves, ensuring accuracy as this determines the bond's total obligation.

- Enter the completion date of the bond in the designated format, ensuring it reflects the day, month, and year accurately.

- In the section regarding the written agreement, provide the date and details as requested regarding the agreement between the Principal and Obligee.

- Complete the terms of payment by entering the amount due from the Principal specified in the agreement.

- Indicate the security amount requested by the Obligee as it correlates to the payment amount specified earlier.

- Review all entered information for accuracy, then proceed to sign the document electronically as the Principal and have it properly dated.

- Lastly, evaluate your options to save changes, download, print, or share the completed document as necessary.

Complete your documents online today for a seamless experience.

Thus, when a party liable to perform the obligations as per the contract refuses to oblige, the defaulting party has the right to recover the damages and losses incurred by the defaulting party. The most common example of an Indemnity Bond is the General Insurance policy.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.