Loading

Get Form 400 Itr 2012-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 400 ITR online

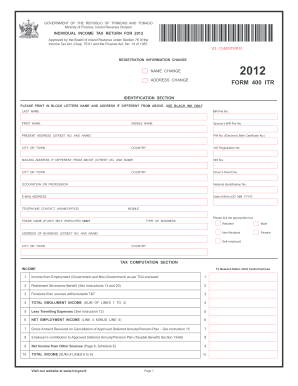

Completing the Form 400 Individual Tax Return (ITR) online can streamline the tax filing process and help ensure that all information is submitted accurately. This guide provides step-by-step instructions for effectively filling out this essential form, tailored for users of all expertise levels.

Follow the steps to complete the Form 400 ITR online:

- Use the 'Get Form' button to obtain the Form 400 ITR and open it in the editor.

- Begin by filling out the identification section. Ensure you use block letters and black ink. Provide your last name, first name, and middle name as required. Include your present address, email address, and contact numbers.

- In the tax computation section, enter your income details. You will need to report your income from employment, retirement benefits, and pensions. Ensure that any travel expenses are accounted for to determine your net employment income.

- Complete the deductions section, including any tertiary education expenses and donations. Calculate your total net income by subtracting allowable deductions from your total income.

- Declare your assessable income by deducting your personal allowance from the total net income. This is crucial in determining your tax liability.

- Next, fill out any relevant sections for tax credits or prepayments. Include details for any tax credits you are eligible for based on your income and contributions.

- Finally, review all entered information for accuracy. Once confirmed, you can save changes, download, or print the completed form for submission.

Please ensure you complete your Form 400 ITR online to facilitate a smooth tax filing process.

Related links form

If you find that all deductions are disabled in your ITR, it may be due to the specific form you are using or your income type. For instance, certain forms have predefined rules that limit deduction claims. To resolve any confusion and get advice on your Form 400 ITR, consider using the expert resources on the uslegalforms platform.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.