Loading

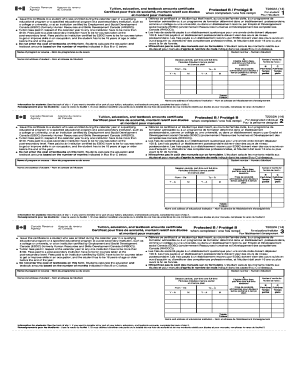

Get Canada T2202a 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T2202A online

The Canada T2202A form is a vital document for students seeking to claim tuition, education, and textbook amounts. This guide will provide step-by-step instructions on how to fill out the form online, ensuring you can access the benefits you deserve.

Follow the steps to successfully complete your T2202A online.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Enter the student number in the appropriate field. This is essential for identifying your records within the educational institution.

- Provide the name of the program or course in which you were enrolled during the calendar year. This information is necessary for validating your eligibility.

- Fill in the name and address of the student accurately, ensuring all details are current and match your official documents.

- Specify the session periods, indicating both the start and end dates of your study duration, using the required year-month format.

- Enter the eligible tuition fees paid for both part-time and full-time sessions. Ensure these fees exceed $100, as required by the guidelines.

- Indicate the number of months of enrollment for both part-time and full-time sessions, inputting this data in the spaces provided.

- Provide the totals in the designated fields, summarizing the tuition amounts and any relevant information.

- Input the name and address of the educational institution. This is crucial for proper recognition and processing of the form.

- Review all entered information for accuracy and completeness, ensuring there are no errors.

- Once completed, save changes to the form. You can then download, print, or share the form with your tax return or financial institution as needed.

Complete your T2202A form online today and ensure you maximize your claims for tuition and education expenses.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The $2000 tax credit in Canada typically goes to taxpayers who qualify for specific tax credits associated with education expenses. To receive this credit, ensure you have the appropriate documentation, such as the Canada T2202A, to support your claim. This form serves as an important tool in your journey to maximize your tax benefits.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.