Loading

Get Canada Nr73 E 2017-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada NR73 E online

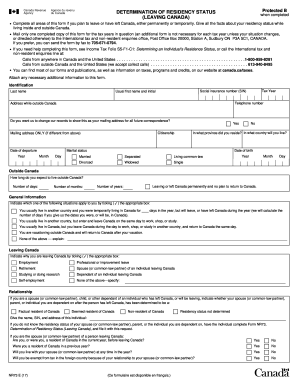

The Canada NR73 E form is essential for individuals who are leaving Canada and need to declare their residency status. Completing this form accurately ensures that your tax obligations are clear while residing outside Canada.

Follow the steps to successfully fill out the Canada NR73 E online

- Press the 'Get Form' button to obtain the Canada NR73 E online and open it in your preferred editor.

- Begin by providing your identification details, including your last name, social insurance number (SIN), date of birth, and a telephone number.

- Fill in your address while outside Canada, and indicate if you want this to be your mailing address for all future correspondence.

- Specify your marital status, selecting from the options such as married, separated, or single.

- Indicate the province where you resided before leaving and the country where you will be living.

- Provide details on your departure date and the expected duration of your stay outside Canada, including the number of days, months, or years.

- Choose the situation that applies to you regarding your residency status and transient activities in Canada and abroad.

- Select the reason for leaving Canada from the options provided, such as employment or retirement.

- If applicable, provide information on ties you will maintain in Canada, including family relationships and property.

- Certify the information by signing and dating the form, ensuring that the information provided is complete and accurate.

- Finally, review the form thoroughly for any missing information, and then save, download, print, or share the completed document as needed.

Ensure your residency status is accurately represented by completing the Canada NR73 E form online today.

Yes, US citizens must complete the ArriveCAN form when entering Canada, especially for travel reasons. This form helps the Canadian government manage public health measures. Additionally, it can streamline your entry process, allowing you to focus on your visit rather than bureaucratic hurdles.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.