Loading

Get Il Bca-14.30 2003-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IL BCA-14.30 online

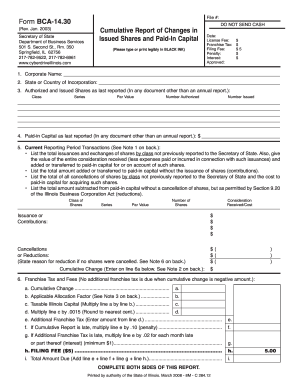

Filling out the IL BCA-14.30 form online can be a straightforward process. This guide provides clear, step-by-step instructions to help you complete the cumulative report of changes in issued shares and paid-in capital with ease.

Follow the steps to complete the IL BCA-14.30 form online.

- Begin by locating the 'Get Form' button. Press this button to access the form and open it in your chosen online editor.

- Fill in the date, which corresponds to when you are completing the form.

- Add the license fee and franchise tax amounts, as well as the filing fee of $5, any penalties if applicable, and interest if applicable.

- In section 1, clearly state the corporate name.

- In section 2, indicate the state or country where your corporation was incorporated.

- For section 3, provide the authorized and issued shares as last reported, including details like class, series, par value, number authorized, and number issued for each class of shares.

- In section 4, enter the amount of paid-in capital as last reported.

- Section 5 requires you to detail current reporting period transactions. List all issuances, exchanges of shares, contributions, cancellations, and any reductions to paid-in capital, along with corresponding values.

- Fill out section 6 by calculating the franchise tax and fees based on your cumulative changes and any applicable factors.

- Complete section 7 by reporting any transactions that occurred during previous reporting periods and were not reported previously.

- In section 8, report the authorized and issued shares after changes.

- Enter the updated paid-in capital amount in section 9.

- Finally, in section 10, ensure the form is signed by an authorized officer of the corporation, ensuring all details are true and correct.

- After completing the form, you will have the option to save your changes, download a copy, print it, or share it as needed.

Complete your documents online today and ensure all your filings are accurate and timely.

Related links form

The Illinois Business Corporation Act (BCA) is a set of laws governing business entities in Illinois. Specifically, IL BCA-14.30 addresses the responsibilities and requirements for LLCs, including filing annual reports. Understanding the BCA can help you navigate your business obligations more efficiently. For comprehensive resources and support, US Legal Forms provides valuable tools tailored to meet these specific needs.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.